Watch 247BroadStreet YouTube Video

Helpful Articles

Inspirational Quotes on Life, Success and Investing

The Potential of a Profitable Tiger Nut Business

How to Make Money with Metaverse

Starting and Running a Moringa Business

Metaverse Investing: An Investment Opportunity

How to Grow Your YouTube Channel and Start Making Money

Bing AI vs ChatGPT: A Comparative Analysis

Mindset and Habits of Successful Millionaires

Can AI Revolution Replace Blogging?

Nigerian NollyWood in the Global Film Markets

Guide on How to Export Tiger Nuts from Nigeria

Personal Growth and Overcoming Poverty Mentality

To Everything There is a Season

Healthier Living Tips

Comprehensive Guide on How to Export Products From Nigeria

How to Start a Profitable Peanuts Business: A Comprehensive Guide

Vanity Upon Vanity, All Is Vanity

The World of Angel Investors

Don't Give Up: Embracing Resilience and Overcoming Challenges

Investing in India: The Risks and Rewards

Investment Opportunities: Investing in Emerging Markets

Guide on How to Export Bitter Kola from Nigeria

How to Start a Profitable Sesame Seed Business

Pandora Papers Revelation: The Secret Asset of Nigerian Elites

How to Start a Mushroom Farm Business

How to Start a Profitable Cashew Nuts Business: A Comprehensive Guide

Guide on How to Start a Profitable Shrimps Business

How to Start a Profitable Garlic Business

How to Start a Profitable Cashew Nuts Export from Nigeria

Comprehensive Guide: How to Export Kola Nut from Nigeria

How to Start a Ginger Business

The Great Stock Market Crash of 1929

Ways to Make Money as a Teenage Entrepreneur

Guide on How to Invest in the Ghana Stock Exchange (GSE)

How to Start a Profitable AirBNB Business

The Ultimate Guide to: Making Plantain Chips in Nigeria

How to Start a Profitable Cotton Business

Non-Fungible Tokens (NFTs) Revolution

Sesame Seed Export from Nigeria: Unlocking the Potential

How to Start a Cotton Export from Nigeria

Stock Market Investing in India

Guide on How to Start a Profitable Palm Kernel Oil Business

Guide on How to Export Charcoal from Nigeria

Shrimps Export from Nigeria

How to Start a Fruit Juice Production Business

How to Naturally Lower Your Blood Pressure

Beekeeping: Secrets to Successful Honey Production Business

How to Make Mega Money in the Chinese Market

Garlic Export from Nigeria: Unlocking the Potential of a Flavorful Commodity

The Ultimate Guide: Best Places to Invest Your Money in Africa

Economic Outlook and Nigeria Capital Markets

Solar Energy: Green Energy, Renewable Energy and the Environment

How to start a Profitable Snail Farming Business

The Ultimate Guide to: Writing a Comprehensive Gold Mining Business Plan

Make Money Investing in Ghana

How to Make More Money Investing in the United States of America

Comprehensive Guide: Making More Money in Canada

How to Start a Profitable Vending Machine Business

Investing in South Africa: Opportunities to Grow your Wealth

How to start a Profitable Handmade Soap-Making Business in Nigeria

Work From Home Job Companies That are Always Hiring

How to start a Profitable Cosmetics Production Business in Nigeria

Crude oil: Unveiling the Backbone of Nigeria's Economy

Where to Buy and Sell Gold in Ghana

Grow your Wealth: Investing in Brazil

Off Grid Solar Power Systems for Homes

Learn How to Start your own Automated Teller Machines Business

Make Money Investing in Kenya

Investment Opportunities to Grow your Wealth in Australia

How to Start, Run and Grow a Successful Care Home Business

Financial Freedom with Real Estate Investing

How to Start a Profitable Candle-Making Business in Nigeria

Cybersecurity: The Dark Web, Hacking and Tor

Start and Grow your Own Consulting Business

The Impact of Petrol Subsidy Removal on the Nigeria Capital Markets

How to start drop shipping business for free

Ethical Hacking Techniques

Copper as a Precious Metal

How to Write a Winning Business Plan

Unlocking Investment Opportunities in Rwanda

Building a Strong Stock Portfolio with Dividend Growth Stocks

Biotechnologies:Paving the way for a greener future

Protect and Safeguard your Wealth with Offshore Investments

How to start and run a Gas station business

Vast opportunities for investment and business in Nigeria

How do I make Money with Cryptocurrency

Shale oil: Unlocking the potential of unconventional energy resources

How does Block Chain Network Works

Ways to make money online with ChatGPT

Organic Grow Bag Farming in Nigeria

How To Be Financially Intelligent With Money

How to lose weight fast and feel great

How do I make Money on FaceBook

How to lower your blood sugar

How To Create Wealth With The Extraordinary Power Of Compound Interest

Foreign Portfolio Managers Are Investing In Nigeria Stock Market

Blockchain - The Biggest Revolution In Financial History

Helping You Make Better Investment Decisions in the Nigerian Stock Exchange

As a Man Thinketh

How To Become A Commercial Real Estate King

Insights for Growing Your Wealth

Positive Thinking Everyday

Nigeria stock market

Investing In African Stocks Like The Nigeria Stock Market

Essential Guide To Investing In Treasury Securities

Nigerian Stock Market Information

Nigerian Stock Market Investing: How To Become Rich Like Warren Buffett And Bill Gates

Guide To Fast Credit Score Repair

Now is The Perfect Time to Invest in the Nigerian Stock Market

Earn A Fortune In The Finder’s Fee Business

Smart Investors Are Buying Nigerian Stocks

Stock Market Investing

Essential Guide To Owning A Money Making Franchise Business

The Best and Most Surefire Way of Building Wealth in Troubled Times

The Nigerian Stock Exchange Offers A Recession-Proof Cash Stream

Essential Guide To Making Money With Rare Coins, Postage Stamps And Banknotes

The Rise of Nigerian Stocks on the Nigerian Stock Exchange

Time of greatest fear offers opportunity

Learn How To Make Your Fiction & Nonfiction Book Work Harder And Make More Money

Quick Start Guide To Making Money In The Online Dropshipping Business

Quick Start Guide To Etsy Selling. Snapchat, Instagram And Pinterest Marketing For Business

Essential Guide To Making Money Online On YouTube For Business Growth

Guide To Starting Your Own Import And Export Business

Think Very Big And Grow Your Business

How To Start A Classified Ads Website For Making Money Online

How To Start and Make Money Building Your Own Online Forum

Make Money by Growing Vegetables and Mushrooms

Money Mаking in Cаѕѕаvа Fаrming Business - Stаrt аn Agriсulturаl Recession Proof Buѕinеѕѕ in Hаrd Timеѕ

Ways To Make Money From Poultry Farming Business

How to Make Money with Your WordPress Blog or Website

Ways You Can Make Money From Pig Farming Business

Creative Ways To Make Money From Fish Farming (Catfish, Tilapia)

Making Money With Compost Manure, Fertilizer

Palm Kernel Oil Processing - Business Opportunities in Red Palm Oil Production

Ready To Make Extra Money? Get Paid To Take Surveys Online

How To Make Money in the Oil and Gas Business - (Oil and Gas Business Opportunities)

Quick Start Guide To Outsourcing Your Business Process To India

Great Money Making Agriculture Business Ideas in Nigeria - (A Money Spinner)

Top 5 Website Hosting Companies To Host a Website or Blog

Plantain and Banana Farming: Money Making Agriculture Business Ideas

Cattle, Goat and Sheep Farming Business - (Surprising Ways to Make Money)

Ways You Can Make Money From Snail Farming Business

How To Make Money in China? Great Money Making Business Ideas in China

How To Make More Money Online: Ways To Make Extra Money Even With a Full Time Job Selling on eBay - Complete guide

Stop Wasting Time Looking For a Job, Just Blog it and Start Making Full Time Income Online

The Essential Guide To Personal Success

Great Side Hustle Small Business Ideas and Opportunities To Make Money in Nigeria

Amazing Business Ideas and Innovative Ways To Make as Much Money as You Want

Want to Make Money in India? Amazing Money Making Business Ideas in India

How to Invest Beyond the Stock Market: Beginners Guide to Alternative Investments for Income (Latest Money Making Ideas)

Easy Ways To Make Money: Interesting Business Opportunities For Forward Thinking Entrepreneurs

Want More Interesting Online Business Ideas? Learn How to Start Making Money Selling on Amazon - Complete Guide

Financial Freedom and Wealth Creation Formula: Discover How to Build Sustainable Wealth and Become Financially Free

Poverty: So, You Want to Remain Financially Poor? Great Ways to Become Financially Poor and Remain Poor

Want to Start a Business Career Online? The Essential Things You Need To Know Before You Start a Money Making Internet Business

Immigrants and the Most Popular Jobs: Seasonal Work, Skilled, Unskilled and Highly-Skilled Jobs Opportunities in the United States of America for Foreigners or Immigrants ( Top Jobs Among All Immigrants In The United States Of America )

A Healthier Choice: Quick and Ridiculously Easy Ways to Get Active, Get Healthier, Feel Great, Look Better, Improve Your Overall Health and Wellbeing Fast (Health & Well-Being Tips)

Want To Retire Early? How To Plan For Retirement - Here Are The Steps To Take If You Want To Retire Early (Essential Tips and Tricks)

Genuine Ways To Make Money: Here Are Some Business Ideas To Get You Started (Surprisingly Easy Methods To Make Money)

Looking For Great Investment Ideas To Make Money? Here Are Some Smart, Profitable and Lucrative Business Investment Ideas You Can Launch for Cheap

How To Get More Traffic to My Website? Effective Ways to Instantly Get High Quality Web Traffic to Your Website or Blog and Make More Money Online - (Website Traffic Tips)

Craigslist Money Making Opportunities: A Creative Guide to Successfully Make a Full-Time Income Selling on Craigslist (Tips to Make Money on Craigslist)

Affiliate Marketing Sales: Make Multiple Streams of Income with Affiliate Marketing (Work at Home Jobs - Get More Traffic and Sales With Affiliate Marketing)

Money Management: Simple Tips to Reach Financial Freedom - Beginners Guide to Saving Money, Living a Debt Free Life and Retire a Millionaire

Legitimate Work From Home Job Opportunities For Stay at Home Moms and Dads That Are Easy to Start (Unique Side Hustles Business Ideas and Great Second Jobs For Extra Money)

The Most Lucrative and Proven Side Hustles Business Ideas for Medical Professionals, Attorneys or Lawyers and Accountants & Auditors

Skilled, Unskilled and Highly-Skilled Immigrants Jobs in the United Kingdom: Britain's Most In-Demand Immigrants Jobs Revealed - High Demand Jobs For Foreigners In The United Kingdom (Jobs In The United Kingdom For Foreigners or Immigrants)

Gold’s Role As Money: Gold Standard Perspective On Financial Systems And The World’s Economy - The Most Perfect Monetary System – (The Gold Standard is a Better Monetary System)

Why Invest In Nigeria? Reasons Why You Should Invest In The Nigerian Economy – (Best Investment And Business Opportunities In Nigeria)

The Ultimate Pinterest Strategies: Pinterest Strategies to Quickly Grow and Drive Huge Traffic To Your Website or Blog - Make Pinterest Work For Your Business ( Pinterest Marketing Tips and Strategies )

How To Run a Successful Email Marketing Campaign: Using Email To Promote and Grow Your Business - (Must Have Tips To Create a Successful and Effective Email Marketing Strategies)

Vlogging On YouTube: How To Make Money Online Through Vlogging On YouTube - ( Tips To Get Started Making Money Vlogging)

Experience African Vacations: The Most Amazing and Popular Travel Destinations to Visit in Africa (Tourist Attractions in Africa)

Where To Invest In Africa? The Top 6 Most Attractive African Countries To Invest Your Money And Reasons To Invest In Africa - (African Countries With Good Investment Potentials)

The Most Attractive Countries In Asia To Invest Your Money - Investment Opportunities in Asia

Getting to Know…The Kitchen Porters - KP for Short (Diary of an Immigrant or Foreigner as a Kitchen Porter or Kitchen Steward in the United Kingdom)

Investment Opportunities in Africa: How You Can Build Sustainable Wealth Investing in Africa (Ways to Build Wealth in Africa)

Offshore Investment Opportunities: Most Attractive Offshore Locations To Invest Your Money (The World's Top Offshore Countries To Put Your Money)

Look Before You Invest Your Money: Absolutely Important Things To Ask Yourself Before Investing (Invest Your Money Safely)

17 Profitable Business Ideas and Quick Ways to Make Money in Nigeria

Diary of an Immigrant or Foreigner in the United States of America – ( Immigrant Experience in America )

The Smartest Way to Avoid or Spot Investment Scam Signs and Swindles (Protect Yourself from Investment Fraud)

How can I Survive any Financial Crisis, Economic Downturn or Recession? Key Tips on How to Survive a Financial Crisis and Prosper : (Surviving the Global Financial Holocaust, Great Recession or Global Economic Meltdown)

Small Business Failure: Major Reasons Small Businesses or Companies Fail - Common Causes of Business or Startups Failure

Investing for Beginners: Simple Practices to Help You Reach Your Investment Goals - Build Your Investment Portfolio to Maximize Returns

Can I Really Make a Living by Blogging? How Much Money Can I Make Blogging?

Biblical Investing: Biblical Wisdom for Business and Investing: Learn Solid Investing Principles from the Bible

17 Critical Factors You Should Consider Before Purchasing Land as an Investment: [ The Best Investment on Earth, Is Land: Here is a Land Investment Checklist ]

24 Ways to Make Money Online Blogging (Proven Strategies to Actually Make Money Online and Easily Earn Revenue with a Blog)

8 Unique Differences Between the Rich and Poor People

10 Simple Tips on How to Secure WordPress Blog or Website from Hackers

7 Frustrating Reasons Why Your Website Speed is Painfully Slow

10 Important Reasons Why You Should Invest Your Money

7 Most Important Factors to Consider Before Buying Nigerian Stocks

6 Top Reasons for Bankruptcies

9 Things You Need to Know Before You Start a Soap Production Business

7 Practical Steps Anyone Can Actually Take To Become Rich Legitimately

The 5 Powerful Things You Absolutely Must Know Before Investing in the Nigerian Stock Market

Top 6 Reasons Why Most Websites Fail and are Unsuccessful

8 Awesome Tips on How to Boost Your Income While Working Full Time

9 Critical Things I Wish I Had Known Before I Started My Photograhy Business

9 Basic Things You Need to Consider Before Buying or Investing in any CryptoCurrency

8 Things to Consider When Investing in Penny Stocks

9 Easy Ways to Make Money with Drone Photography and Video

Peer to Peer (P2P) Crypto Trading for Nigerians on Binance Exchange - How To

8 Valuable Tips to Know Before You Start a Candle Making Business

The Top 9 Reasons to Sell Your Website or Blog Online

Buy and Sell Crypto Currencies on CoinBase - How To

26 Super Successful Christian Businesses You've Never Seen Before

Buy and Sell Crypto Currencies on Binance Exchange

Buy and Sell Crypto Currencies on HOTBIT

Financial Education for Churches

How to keep livestock animals healthy

How to write effective agriculture proposals

How to use ChatGPT to become a millionaire

Shea Butter Business

Discussions on Nairaland forum - Nigeria's largest online community

Natural ways to whiten teeth at home fast

The best anti aging tips of all time

How to set up bakery business

Palm oil storage business and Chicken farming

Guide on How to Export Yam Tubers from Nigeria

How to write effective business proposals

Meat sausage processing - How To

Comprehensive Guide on How to Export Moringa from Nigeria

Best Tips to Safely Store Your CryptoCurrency Private Keys from Hackers

Prescription for Wealth: Why Didn't They Teach Me How to Manage Money in School? Your Simple Guide to Personal Finance and Financial Abundance (Here’s the book you never had in class)

How to Write a Bureau De Change Business Plan

Chapter 1: Introduction to Bureau De Change Business Overview of the Bureau De Change industry Importance of a business plan Chapter 2: Executive Summary A concise summary of the business plan Key components and objectives Chapter 3: Company Description Background information on the Bureau De Change business Legal structure and ownership details Chapter 4: Market Analysis Identification of target market segments Analysis of competition and market trends Chapter 5: Services and Products Description of the currency exchange services offered Additional services, such as money transfers or travel-related services Chapter 6: Pricing Strategy Determining competitive exchange rates Considerations for fees and commissions Chapter 7: Marketing and Sales Strategy Marketing channels to reach customers Sales techniques and customer acquisition strategies Chapter 8: Organizational Structure and Management Roles and responsibilities of key team members Staffing requirements and recruitment strategies Chapter 9: Operational Plan Location and facilities requirements Operational processes for currency exchange transactions Chapter 10: Technology and Systems Required hardware and software systems Security measures for handling financial transactions Chapter 11: Risk Management Identification and assessment of potential risks Strategies for mitigating risks, such as fraud or exchange rate fluctuations Chapter 12: Financial Projections Projected revenue and expenses Break-even analysis and profitability forecast Chapter 13: Start-up Costs and Funding Calculation of initial investment requirements Funding options, such as loans or investment partners Chapter 14: Implementation Timeline Detailed timeline for setting up the Bureau De Change business Milestones and key activities Chapter 15: Legal and Regulatory Compliance Overview of applicable laws and regulations Licensing and permit requirements Chapter 16: SWOT Analysis Identifying strengths, weaknesses, opportunities, and threats Strategies to capitalize on strengths and opportunities while addressing weaknesses and threats Chapter 17: Marketing Plan Branding and positioning strategies Advertising and promotional activities Chapter 18: Customer Relationship Management Strategies to build and maintain customer relationships Loyalty programs and customer feedback mechanisms Chapter 19: Competitive Analysis Comparative analysis of competitors' strengths and weaknesses Differentiation strategies Chapter 20: Financial Management Bookkeeping and accounting processes Financial controls and reporting mechanisms Chapter 21: Exit Strategy Options for exiting or selling the business in the future Succession planning Chapter 22: Appendix Supporting documents, such as resumes, licenses, permits, and market research data Chapter 23: Industry Trends and Future Outlook Emerging trends in the Bureau De Change industry Anticipated challenges and opportunities Chapter 24: Economic Factors and Exchange Rate Analysis Factors influencing currency exchange rates Strategies to manage exchange rate risks Chapter 25: Customer Segmentation and Targeting Defining customer segments and their specific needs Tailoring marketing strategies to reach each segment Chapter 26: Customer Acquisition Channels Online channels (websites, social media, etc.) Offline channels (partnerships, advertising, etc.) Chapter 27: Customer Retention Strategies Building customer loyalty and repeat business Personalized services and ongoing customer engagement Chapter 28: Staff Training and Development Training programs to enhance employee skills Ensuring compliance with regulatory requirements Chapter 29: Competitive Pricing Strategies Pricing strategies to remain competitive Balancing profitability with customer value Chapter 30: Sales Forecasting and Performance Tracking Tools and techniques for sales forecasting Regular performance monitoring and adjustment strategies Chapter 31: Operational Efficiency and Process Optimization Streamlining processes to improve efficiency Automation and technology integration Chapter 32: Risk Mitigation Strategies Fraud prevention measures Insurance coverage for potential risks Chapter 33: Financial Analysis and Key Metrics Financial ratios and performance indicators Analysis of profitability, liquidity, and solvency Chapter 34: Funding Options and Investor Pitch Identifying potential investors Crafting a compelling investor pitch Chapter 35: Business Expansion Strategies Scaling the business through new locations or services Partnerships and collaborations for growth Chapter 36: Customer Feedback and Continuous Improvement Gathering customer feedback and implementing improvements Monitoring customer satisfaction and loyalty metrics Chapter 37: International Regulatory Compliance Compliance with anti-money laundering (AML) and know your customer (KYC) regulations International trade and financial reporting requirements Chapter 38: Sustainability and Corporate Social Responsibility Implementing sustainable practices in the business Contributing to the community and environmental initiatives Chapter 39: Crisis Management and Business Continuity Developing a crisis management plan Ensuring business continuity during unforeseen events Chapter 40: Exit Planning and Succession Strategies for exiting the business or passing it on to a successor Valuation methods and negotiations Chapter 41: Legal Considerations for Expansion Legal requirements for expanding to new locations or offering new services Intellectual property protection and contracts Chapter 42: Technological Advancements and Innovation Adopting new technologies in the Bureau De Change industry Innovation strategies to stay ahead of competitors Chapter 43: Employee Engagement and Motivation Employee recognition programs Building a positive work culture Chapter 44: Monitoring and Evaluating Key Performance Indicators Defining and tracking performance metrics Regular evaluation and adjustment of business strategies Chapter 45: Partnerships and Alliances Identifying potential partnerships and alliances Collaboration strategies for mutual growth Chapter 46: Crisis Communication and Reputation Management Developing a crisis communication plan Protecting and managing the business's reputation Chapter 47: Industry Associations and Networking Benefits of joining industry associations Networking opportunities and industry events Chapter 48: International Expansion Strategies Exploring opportunities for expanding into foreign markets Regulatory and cultural considerations Chapter 49: Continuous Learning and Professional Development Staying updated on industry trends and best practices Investing in professional development for the team Chapter 50: Conclusion Summarizing the key points covered in the business plan Emphasizing the importance of ongoing planning and adaptation

Chapter 1: Introduction to Bureau De Change Business 1.1 Overview of the Bureau De Change Industry The Bureau De Change industry plays a vital role in facilitating currency exchange for individuals and businesses. It serves as a crucial link between travelers, international businesses, and the foreign exchange market. Bureau De Change businesses provide services such as buying and selling foreign currencies, money transfers, and travel-related services. 1.2 Importance of a Business Plan A well-crafted business plan is essential for a Bureau De Change business. It serves as a roadmap for success, guiding entrepreneurs through the process of establishing and managing their business effectively. A comprehensive business plan helps define goals, identify target markets, analyze competition, develop marketing strategies, secure funding, and ensure operational efficiency. Chapter 2: Executive Summary 2.1 Overview of the Executive Summary The executive summary is a concise overview of the Bureau De Change business plan. It provides a high-level summary of the key components, objectives, and strategies outlined in the plan. It is typically the first section of the plan and serves as an introduction to potential investors, partners, and stakeholders. 2.2 Key Components of the Executive Summary The executive summary includes a brief description of the business concept, its unique value proposition, target market segments, financial projections, and the management team's qualifications. It should highlight the business's potential for profitability and growth, giving readers a compelling reason to continue reading the full business plan. Chapter 3: Company Description 3.1 Background Information on the Bureau De Change Business This section provides an overview of the Bureau De Change business, including its history, purpose, and vision. It explains why the business was established and its long-term goals. It also highlights any unique aspects or advantages that set the business apart from competitors. 3.2 Legal Structure and Ownership Details The company description section outlines the legal structure of the Bureau De Change business, whether it is a sole proprietorship, partnership, or corporation. It also includes information about the business's ownership, such as the names and roles of the founders, partners, or shareholders. Chapter 4: Market Analysis 4.1 Identification of Target Market Segments A thorough market analysis is crucial for understanding the Bureau De Change industry and identifying the target market segments. This section identifies the specific customer groups that the business aims to serve, such as international travelers, businesses engaged in foreign trade, or expatriates. 4.2 Analysis of Competition and Market Trends To gain a competitive advantage, it is essential to analyze the existing competition and market trends. This section provides an overview of competitors in the Bureau De Change industry, their strengths and weaknesses, market share, and pricing strategies. It also examines market trends, such as changes in exchange rates, regulations, and customer preferences. Chapter 5: Services and Products 5.1 Description of Currency Exchange Services Offered The Bureau De Change business primarily offers currency exchange services. This section provides a detailed description of the exchange services provided, including the range of currencies available, transaction methods (cash or electronic), and any additional services offered, such as traveler's checks or prepaid travel cards. 5.2 Additional Services, such as Money Transfers or Travel-Related Services Many Bureau De Change businesses diversify their offerings to meet customer needs and generate additional revenue streams. This section outlines any additional services provided, such as international money transfers, travel insurance, or assistance with travel arrangements. It highlights the value these services bring to customers and the business's competitive advantage. Chapter 6: Pricing Strategy 6.1 Determining Competitive Exchange Rates Pricing plays a critical role in the Bureau De Change business. This section explains how the business sets competitive exchange rates by considering factors such as current market rates, transaction costs, and desired profit margins. It also outlines strategies for monitoring and adjusting rates to remain competitive in the market. 6.2 Considerations for Fees and Commissions In addition to exchange rates, Bureau De Change businesses often charge fees or commissions for their services. This section describes the fee structure, including any flat fees, percentage-based commissions, or service charges. It also explains how the business determines these fees while considering factors such as market norms, cost structure, and customer value perception. Chapter 7: Marketing and Sales Strategy 7.1 Marketing Channels to Reach Customers An effective marketing strategy is essential for attracting customers and building awareness of the Bureau De Change business. This section outlines the marketing channels to be utilized, such as digital marketing (website, social media, online advertising) and traditional marketing (print media, billboards, radio). It also includes strategies for targeting specific customer segments through each channel. 7.2 Sales Techniques and Customer Acquisition Strategies This section explores sales techniques and customer acquisition strategies specific to the Bureau De Change industry. It may include approaches like personal selling, referral programs, strategic partnerships with travel agencies or hotels, or incentives for repeat customers. The strategies outlined should align with the business's target market and its unique selling proposition. Chapter 8: Organizational Structure and Management 8.1 Roles and Responsibilities of Key Team Members The organizational structure outlines the roles and responsibilities of key team members within the Bureau De Change business. This section identifies the positions and functions, such as CEO, operations manager, finance manager, and compliance officer. It also provides an overview of their qualifications and relevant experience. 8.2 Staffing Requirements and Recruitment Strategies To ensure operational efficiency and customer satisfaction, this section outlines the staffing requirements for the Bureau De Change business. It includes the number of employees needed, their skills and qualifications, and the recruitment strategies for attracting and retaining talent. It may also address training and development programs for staff members. Chapter 9: Operational Plan 9.1 Location and Facilities Requirements The operational plan specifies the physical requirements for the Bureau De Change business, such as location and facilities. This section outlines the ideal location based on target market proximity, accessibility, security, and visibility. It also describes the facilities needed, such as office space, cash handling systems, security measures, and technology infrastructure. 9.2 Operational Processes for Currency Exchange Transactions To ensure smooth operations, this section details the processes involved in currency exchange transactions. It covers customer verification procedures, transaction documentation, cash handling protocols, reconciliation processes, compliance with regulatory requirements, and customer service protocols. It also addresses procedures for handling exceptional cases, such as large transactions or exotic currencies. Chapter 10: Technology and Systems 10.1 Required Hardware and Software Systems Technology plays a crucial role in the Bureau De Change business. This section outlines the necessary hardware and software systems, such as currency exchange software, accounting systems, customer relationship management (CRM) tools, security systems, and communication infrastructure. It also includes considerations for system integration and scalability. 10.2 Security Measures for Handling Financial Transactions Given the nature of the business, security is of utmost importance. This section explains the security measures in place to protect financial transactions, customer data, and physical assets. It covers measures like data encryption, secure storage, surveillance systems, employee background checks, and compliance with data protection regulations. Chapter 11: Risk Management 11.1 Identification and Assessment of Potential Risks Every business faces various risks, and Bureau De Change businesses are no exception. This section identifies and assesses potential risks, such as fraud, exchange rate fluctuations, regulatory compliance, liquidity risks, and operational disruptions. It also considers the potential impact of these risks on the business's financial health and reputation. 11.2 Strategies for Mitigating Risks To minimize the impact of risks, this section outlines strategies for mitigating them. It includes measures such as implementing robust internal controls, conducting regular audits, monitoring market conditions, implementing risk management policies, and obtaining appropriate insurance coverage. It emphasizes the importance of continuous monitoring and updating of risk management strategies. Chapter 12: Financial Projections 12.1 Projected Revenue and Expenses Financial projections are crucial for evaluating the viability and profitability of the Bureau De Change business. This section includes projected revenue estimates based on transaction volumes, average transaction values, and pricing strategies. It also outlines the expected expenses, including staffing costs, rent, marketing expenses, technology investments, and regulatory compliance costs. 12.2 Break-Even Analysis and Profitability Forecast A break-even analysis helps determine the point at which the business becomes financially self-sustaining. This section calculates the break-even point by considering fixed costs, variable costs, and the contribution margin. It also includes a profitability forecast that outlines the expected net income over a specific period, considering revenue growth and cost management strategies. Chapter 13: Start-up Costs and Funding 13.1 Calculation of Initial Investment Requirements Starting a Bureau De Change business requires an initial investment to cover various start-up costs. This section provides a detailed breakdown of these costs, including licensing and permit fees, rental deposits, technology and equipment purchases, marketing expenses, staffing costs, and working capital requirements. It highlights the total amount needed to launch the business successfully. 13.2 Funding Options, such as Loans or Investment Partners To secure the necessary funds, this section explores different funding options available to the Bureau De Change business. It discusses traditional financing options like bank loans, lines of credit, or government grants. It may also consider alternative funding sources such as angel investors, venture capital, crowdfunding, or strategic partnerships. It evaluates the pros and cons of each option and outlines the steps to secure funding. Chapter 14: Implementation Timeline 14.1 Detailed Timeline for Setting up the Bureau De Change Business This section presents a detailed timeline that outlines the key activities and milestones involved in setting up the Bureau De Change business. It includes tasks such as securing permits and licenses, finding a suitable location, establishing banking relationships, setting up IT infrastructure, hiring and training staff, and launching marketing campaigns. The timeline provides a roadmap for the implementation process. 14.2 Milestones and Key Activities Within the implementation timeline, this section highlights specific milestones and key activities. It breaks down the timeline into manageable stages, indicating critical checkpoints, deadlines, and dependencies. This ensures that the implementation process remains organized and progress can be effectively tracked. Chapter 15: Legal and Regulatory Compliance 15.1 Overview of Applicable Laws and Regulations The Bureau De Change business operates within a legal and regulatory framework. This section provides an overview of the laws and regulations that govern the currency exchange industry, such as anti-money laundering (AML) regulations, know your customer (KYC) requirements, and consumer protection laws. It emphasizes the importance of compliance to maintain the business's reputation and avoid legal consequences. 15.2 Licensing and Permit Requirements To operate legally, Bureau De Change businesses must obtain the necessary licenses and permits. This section outlines the specific licensing requirements, such as obtaining a money service business license or a currency exchange license. It explains the application process, associated fees, and any ongoing compliance obligations. It also addresses other permits that may be required, such as zoning or health permits. Chapter 16: SWOT Analysis 16.1 Identifying Strengths, Weaknesses, Opportunities, and Threats A SWOT analysis provides an assessment of the Bureau De Change business's internal strengths and weaknesses, as well as external opportunities and threats. This section analyzes factors like the business's reputation, financial stability, competitive advantages, operational efficiency, customer service quality, and market conditions. It helps identify areas for improvement and strategies to capitalize on strengths and opportunities while mitigating weaknesses and threats. 16.2 Strategies to Capitalize on Strengths and Opportunities Based on the SWOT analysis, this section outlines strategies to leverage the identified strengths and opportunities. It may include initiatives like expanding service offerings, enhancing customer experience, developing strategic partnerships, investing in technology, or entering new markets. The strategies align with the business's long-term goals and aim to maximize competitive advantage. 16.3 Addressing Weaknesses and Threats To address weaknesses and threats identified in the SWOT analysis, this section outlines strategies for improvement and risk mitigation. It may involve initiatives like staff training and development, process optimization, cost management, enhancing cybersecurity measures, diversifying revenue streams, or staying updated with regulatory changes. The goal is to minimize vulnerabilities and proactively address potential challenges. Chapter 17: Marketing Plan 17.1 Branding and Positioning Strategies A strong branding and positioning strategy helps differentiate the Bureau De Change business in a competitive market. This section outlines the brand identity, including the business name, logo, tagline, and brand messaging. It also highlights the unique value proposition and key differentiators that position the business as the preferred choice for currency exchange services. 17.2 Advertising and Promotional Activities This section details the advertising and promotional activities planned to create awareness and attract customers. It identifies the most effective channels and mediums for reaching the target market, such as online advertising, print media, radio, or outdoor advertising. It also includes strategies for leveraging social media platforms, influencer marketing, content marketing, and public relations to generate interest and drive customer engagement. Chapter 18: Customer Relationship Management 18.1 Strategies to Build and Maintain Customer Relationships Strong customer relationships are vital for long-term success in the Bureau De Change business. This section outlines strategies to build and maintain relationships with customers. It includes initiatives such as personalized customer service, loyalty programs, customer feedback mechanisms, and CRM systems to track customer preferences and needs. It emphasizes the importance of delivering exceptional customer experiences to drive customer loyalty and advocacy. 18.2 Loyalty Programs and Customer Feedback Mechanisms To incentivize customer loyalty and gather valuable feedback, this section explains the implementation of loyalty programs and customer feedback mechanisms. It outlines the structure and benefits of loyalty programs, such as exclusive exchange rates, discounts, or rewards for frequent customers. It also discusses feedback mechanisms like surveys, online reviews, or feedback forms to continuously improve service quality and address customer concerns. Chapter 19: Competitive Analysis 19.1 Comparative Analysis of Competitors' Strengths and Weaknesses This section conducts a comparative analysis of the Bureau De Change business's main competitors. It identifies their strengths, such as reputation, service offerings, market share, or technological capabilities. It also assesses their weaknesses, such as limited geographic coverage, suboptimal customer service, or outdated systems. Understanding the competition helps identify opportunities for differentiation and competitive advantage. 19.2 Differentiation Strategies Based on the competitive analysis, this section outlines strategies for differentiating the Bureau De Change business from competitors. It may involve offering unique services, adopting innovative technologies, providing superior customer service, or targeting niche markets. The strategies aim to position the business as the preferred choice for customers seeking currency exchange services and create barriers to entry for new competitors. Chapter 20: Financial Management 20.1 Bookkeeping and Accounting Processes Sound financial management is crucial for the success of any business. This section outlines the bookkeeping and accounting processes to be implemented, including the use of accounting software, chart of accounts, record-keeping procedures, and financial reporting timelines. It emphasizes the importance of accurate financial data for decision-making, tax compliance, and meeting regulatory requirements. 20.2 Financial Controls and Reporting Mechanisms To ensure financial integrity and transparency, this section discusses the financial controls and reporting mechanisms to be established. It includes internal controls for cash handling, reconciliation processes, expense approval procedures, and periodic financial audits. It also highlights the importance of financial reporting, including income statements, balance sheets, and cash flow statements, to track performance and inform strategic decision-making. Chapter 21: Exit Strategy 21.1 Options for Exiting or Selling the Business in the Future Planning for the future, this section discusses options for exiting or selling the Bureau De Change business. It explores different scenarios, such as selling the business to a competitor, passing it on to a family member or key employee, or conducting an initial public offering (IPO) if the business grows significantly. It emphasizes the importance of considering exit strategies early on to maximize value and ensure a smooth transition. 21.2 Succession Planning For businesses with a long-term perspective, succession planning is essential. This section addresses the process of identifying and preparing successors to take over key roles within the Bureau De Change business. It includes strategies for grooming and developing future leaders, documenting processes and knowledge transfer, and establishing a contingency plan in case of unforeseen events. Succession planning ensures business continuity and protects the legacy of the business. Chapter 22: Appendix 22.1 Supporting Documents The appendix section includes supporting documents that provide additional information and validation for the business plan. This may include resumes or profiles of key team members, licenses and permits, market research data, financial statements, partnership agreements, or relevant legal documents. Including these documents enhances the credibility and completeness of the business plan. Chapter 23: Industry Trends and Future Outlook 23.1 Emerging Trends in the Bureau De Change Industry This section discusses the current and emerging trends in the Bureau De Change industry. It may include advancements in technology, regulatory changes, shifts in customer preferences, or geopolitical factors affecting currency exchange rates. Understanding industry trends helps the business anticipate changes and adapt strategies accordingly. 23.2 Anticipated Challenges and Opportunities Based on industry trends, this section identifies potential challenges and opportunities that the Bureau De Change business may encounter. It explores strategies to navigate challenges, such as increased competition or changing regulations, while capitalizing on opportunities like emerging markets or evolving customer needs. It emphasizes the importance of agility and adaptability to stay ahead in a dynamic industry. Chapter 24: Economic Factors and Exchange Rate Analysis 24.1 Factors Influencing Currency Exchange Rates This section examines the economic factors that influence currency exchange rates. It explains concepts such as interest rates, inflation, economic indicators, and geopolitical events that impact exchange rates. It also discusses how fluctuations in exchange rates can affect the Bureau De Change business and strategies for managing exchange rate risks. 24.2 Strategies to Manage Exchange Rate Risks To mitigate the impact of exchange rate fluctuations, this section outlines strategies to manage exchange rate risks. It includes approaches such as hedging techniques, diversifying currency holdings, monitoring market trends, and offering advisory services to customers. The strategies aim to minimize the business's exposure to currency risk and protect its financial stability. Chapter 25: Customer Segmentation and Targeting 25.1 Defining Customer Segments and Their Specific Needs Effective customer segmentation helps tailor marketing strategies and services to specific customer groups. This section identifies different customer segments within the target market and defines their specific needs, preferences, and behaviors. It may include segments such as leisure travelers, business travelers, international students, expatriates, or small businesses engaged in foreign trade. 25.2 Tailoring Marketing Strategies to Reach Each Segment To effectively reach each customer segment, this section outlines strategies for targeting and engaging them. It may involve personalized marketing messages, specific communication channels, tailored service offerings, or partnership collaborations that resonate with the unique needs and preferences of each segment. The strategies aim to maximize customer acquisition and retention within each identified segment. Chapter 26: Customer Acquisition Channels 26.1 Online Channels (Websites, Social Media, etc.) This section explores the online channels that Bureau De Change businesses can utilize to acquire customers. It includes the development of a professional website that provides information on services, exchange rates, and contact details. It also considers social media platforms, search engine optimization (SEO), online advertising, and content marketing strategies to drive traffic, engagement, and conversions. 26.2 Offline Channels (Partnerships, Advertising, etc.) Offline channels are equally important for customer acquisition. This section discusses strategies such as forming partnerships with travel agencies, hotels, or airlines to reach potential customers. It also explores traditional advertising methods like print media, billboards, and direct mail campaigns. Additionally, it may consider participation in trade shows, networking events, or sponsoring local community activities to enhance brand visibility and acquire customers. Chapter 27: Customer Retention Strategies 27.1 Building Customer Loyalty and Repeat Business Customer retention is crucial for sustainable growth. This section outlines strategies for building customer loyalty and encouraging repeat business. It includes initiatives such as loyalty programs, personalized customer communication, special promotions for repeat customers, and regular engagement through newsletters or exclusive offers. The strategies aim to create a loyal customer base and maximize customer lifetime value. 27.2 Personalized Services and Ongoing Customer Engagement To enhance customer satisfaction and foster long-term relationships, this section explores strategies for providing personalized services and ongoing customer engagement. It may involve offering tailored currency exchange solutions, proactive communication to address customer needs, anticipating customer preferences, and providing value-added services such as travel advice or destination-specific information. The goal is to create a positive customer experience and become the preferred choice for currency exchange services. Chapter 28: Staff Training and Development 28.1 Training Programs to Enhance Employee Skills This section discusses the importance of staff training and development in the Bureau De Change business. It outlines training programs to enhance employee skills, such as currency exchange regulations, customer service excellence, fraud detection and prevention, effective communication, and technology utilization. It emphasizes the importance of ongoing training to keep employees updated with industry trends and regulatory requirements. 28.2 Ensuring Compliance with Regulatory Requirements Compliance with regulatory requirements is crucial in the Bureau De Change industry. This section highlights the importance of training staff to ensure compliance with anti-money laundering (AML) regulations, know your customer (KYC) requirements, data protection regulations, and other legal obligations. It addresses the establishment of internal controls and monitoring mechanisms to detect and prevent any compliance breaches. Chapter 29: Competitive Pricing Strategies 29.1 Pricing Strategies to Remain Competitive Competitive pricing is essential for attracting customers in the Bureau De Change industry. This section explores different pricing strategies to remain competitive. It may include offering competitive exchange rates, providing value-added services at competitive prices, price matching guarantees, or implementing dynamic pricing strategies based on market conditions. The pricing strategies aim to balance profitability with customer value perception. 29.2 Balancing Profitability with Customer Value While remaining competitive, it is crucial to maintain profitability. This section discusses strategies to balance profitability with customer value. It includes cost management techniques, optimizing operational efficiencies, negotiating favorable rates with banking partners, and identifying revenue streams beyond currency exchange services. The goal is to ensure a healthy financial performance while providing exceptional value to customers. Chapter 30: Sales Forecasting and Performance Tracking 30.1 Tools and Techniques for Sales Forecasting Accurate sales forecasting helps the Bureau De Change business plan effectively and make informed decisions. This section discusses tools and techniques for sales forecasting, such as historical data analysis, market research, customer segmentation, and industry trends analysis. It also considers factors like seasonality, exchange rate fluctuations, and economic Chapter 31: Operational Efficiency and Process Optimization 31.1 Streamlining Processes to Improve Efficiency Operational efficiency is critical for the Bureau De Change business's success. This section explores strategies for streamlining processes to improve efficiency. It may involve reevaluating workflow, automating manual tasks, implementing standardized procedures, and adopting technology solutions that enhance operational efficiency. The goal is to reduce costs, minimize errors, and increase productivity. 31.2 Automation and Technology Integration Technology plays a vital role in optimizing operations. This section discusses the automation and technology solutions that can be integrated into the Bureau De Change business. It may include currency exchange software, customer relationship management (CRM) systems, accounting software, security systems, and integration with banking platforms. Automating routine tasks and leveraging technology streamlines processes and improves overall efficiency. Chapter 32: Risk Mitigation Strategies 32.1 Fraud Prevention Measures Fraud prevention is crucial in the Bureau De Change business. This section outlines measures to mitigate the risk of fraudulent activities. It includes implementing robust internal controls, conducting background checks on employees, implementing transaction monitoring systems, and adhering to strict compliance procedures. Regular staff training on fraud detection and prevention is also essential. 32.2 Insurance Coverage for Potential Risks Insurance coverage helps protect the Bureau De Change business from potential risks. This section discusses the types of insurance that may be necessary, such as professional liability insurance, general liability insurance, and fidelity bond insurance. It also emphasizes the importance of reviewing insurance coverage regularly to ensure it aligns with the evolving needs and risks of the business. Chapter 33: Financial Analysis and Key Metrics 33.1 Financial Ratios and Performance Indicators Financial analysis provides insights into the Bureau De Change business's financial health and performance. This section discusses important financial ratios and performance indicators, such as return on investment (ROI), profit margin, liquidity ratios, and customer acquisition cost (CAC). It explains how to calculate and interpret these metrics to assess the business's financial position and profitability. 33.2 Analysis of Profitability, Liquidity, and Solvency This section dives deeper into analyzing profitability, liquidity, and solvency of the Bureau De Change business. It explores profitability ratios like gross profit margin and net profit margin, liquidity ratios like current ratio and quick ratio, and solvency ratios like debt-to-equity ratio and interest coverage ratio. It explains how these metrics reflect the financial health of the business and guides decision-making processes. Chapter 34: Funding Options and Investor Pitch 34.1 Identifying Potential Investors This section explores different funding options for the Bureau De Change business. It includes traditional financing options like bank loans, lines of credit, or small business grants. It also discusses alternative funding sources such as angel investors, venture capital firms, crowdfunding platforms, and strategic partnerships. The section provides guidance on identifying potential investors aligned with the business's goals and values. 34.2 Crafting a Compelling Investor Pitch To secure funding, a compelling investor pitch is essential. This section outlines key elements to include in the pitch, such as a concise overview of the business, market analysis, competitive advantage, financial projections, and the return on investment for potential investors. It emphasizes the importance of a well-prepared pitch deck and effective communication to attract investors. Chapter 35: Business Expansion Strategies 35.1 Scaling the Business through New Locations or Services Business expansion is a natural progression for successful Bureau De Change businesses. This section explores strategies for scaling the business through opening new locations or offering additional services. It discusses market research, location analysis, operational considerations, and branding strategies when expanding to new locations. It also explores opportunities to diversify services and revenue streams to drive business growth. 35.2 Partnerships and Collaborations for Growth Strategic partnerships and collaborations can fuel growth for the Bureau De Change business. This section explores potential partnerships with complementary businesses such as travel agencies, hotels, or online travel platforms. It discusses collaboration opportunities for cross-promotion, joint marketing efforts, or bundled services. Effective partnerships can expand the customer base and enhance the business's value proposition. Chapter 36: Customer Feedback and Continuous Improvement 36.1 Gathering Customer Feedback and Implementing Improvements Customer feedback is invaluable for the Bureau De Change business's continuous improvement. This section discusses strategies for gathering customer feedback, such as online surveys, feedback forms, or direct communication channels. It emphasizes the importance of actively listening to customers, addressing their concerns, and implementing improvements based on their feedback to enhance the customer experience. 36.2 Monitoring Customer Satisfaction and Loyalty Metrics Measuring customer satisfaction and loyalty is essential for the Bureau De Change business. This section explores key metrics and methods for monitoring customer satisfaction, such as Net Promoter Score (NPS), customer satisfaction surveys, or customer reviews. It also discusses strategies to enhance customer loyalty, including loyalty programs, personalized services, and proactive customer engagement initiatives. Chapter 37: International Regulatory Compliance 37.1 Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations Operating internationally requires strict compliance with anti-money laundering (AML) and know your customer (KYC) regulations. This section discusses the importance of implementing robust AML and KYC procedures, conducting due diligence on customers, and reporting suspicious activities. It emphasizes the need for ongoing staff training to ensure compliance with international regulations. 37.2 International Trade and Financial Reporting Requirements International trade and financial reporting have specific requirements that the Bureau De Change business must adhere to. This section explores regulations related to foreign exchange transactions, cross-border payments, tax reporting, and financial statements preparation. It discusses the importance of having a thorough understanding of international regulations and engaging professional services when necessary. Chapter 38: Sustainability and Corporate Social Responsibility 38.1 Implementing Sustainable Practices in the Business Sustainability and corporate social responsibility (CSR) are increasingly important considerations for businesses. This section discusses strategies for implementing sustainable practices in the Bureau De Change business. It includes initiatives such as reducing carbon footprint, promoting responsible tourism, supporting local communities, and using environmentally friendly products. It highlights the importance of aligning business practices with environmental and social sustainability goals. 38.2 Contributing to the Community and Environmental Initiatives Giving back to the community and supporting environmental initiatives can enhance the Bureau De Change business's reputation. This section explores ways to contribute, such as engaging in corporate philanthropy, sponsoring local events, supporting educational programs, or participating in environmental conservation initiatives. It emphasizes the value of building strong relationships with the community and being a responsible corporate citizen. Chapter 39: Crisis Management and Business Continuity 39.1 Developing a Crisis Management Plan Unforeseen events can disrupt business operations. This section discusses the importance of developing a comprehensive crisis management plan for the Bureau De Change business. It includes risk assessment, business continuity planning, communication protocols, and contingency measures to mitigate the impact of crises such as natural disasters, political instability, or economic downturns. 39.2 Ensuring Business Continuity During Unforeseen Events Business continuity ensures the Bureau De Change business can continue operating during and after a crisis. This section outlines strategies for ensuring business continuity, such as data backup and recovery plans, remote work capabilities, alternative service delivery channels, and emergency response procedures. It emphasizes the importance of regularly testing and updating the business continuity plan to remain resilient in the face of unexpected events. Chapter 40: Exit Planning and Succession 40.1 Strategies for Exiting the Business or Selling At some point, business owners may consider exiting or selling the Bureau De Change business. This section explores strategies for exiting the business, including selling to a competitor, conducting a management buyout, or transferring ownership to a family member or key employee. It discusses the importance of careful planning, valuation considerations, and engaging professional advisors to ensure a successful transition. 40.2 Valuation Methods and Negotiations Valuing the Bureau De Change business is essential when considering an exit or sale. This section discusses common valuation methods, such as the market approach, income approach, and asset-based approach. It provides insights into negotiating a fair price, engaging with potential buyers, and conducting due diligence to maximize the business's value during the exit or sale process. Chapter 41: Legal Considerations for Expansion 41.1 Legal Requirements for Expanding to New Locations or Offering New Services Expanding the Bureau De Change business to new locations or offering new services involves legal considerations. This section explores the legal requirements, such as obtaining necessary permits and licenses, complying with local regulations, and understanding labor laws and employment practices. It highlights the importance of engaging legal counsel familiar with international business laws and regulations. 41.2 Intellectual Property Protection and Contracts Protecting intellectual property (IP) and establishing proper contractual agreements is vital for the Bureau De Change business. This section discusses strategies for IP protection, such as trademark registration or trade secret protection. It also addresses the importance of well-drafted contracts for partnerships, service agreements, and vendor relationships to protect the business's interests and mitigate legal risks. Chapter 42: Technological Advancements and Innovation 42.1 Adopting New Technologies in the Bureau De Change Industry The Bureau De Change industry is evolving with technological advancements. This section explores emerging technologies that can benefit the business, such as blockchain, artificial intelligence, or mobile payment solutions. It discusses the potential advantages, challenges, and implementation strategies for adopting these technologies to enhance efficiency, security, and customer experience. 42.2 Innovation Strategies to Stay Ahead of Competitors Innovation is key to staying ahead of competitors in the Bureau De Change industry. This section explores innovation strategies, such as developing new service offerings, leveraging data analytics for customer insights, embracing digital transformation, or exploring partnerships with fintech companies. It emphasizes the importance of fostering a culture of innovation and continuously seeking opportunities for improvement. Chapter 43: Employee Engagement and Motivation 43.1 Employee Recognition Programs Engaged and motivated employees are crucial for the Bureau De Change business's success. This section discusses the implementation of employee recognition programs to acknowledge and reward outstanding performance. It explores strategies like employee of the month awards, performance-based incentives, or team recognition events to foster a positive work environment and enhance employee morale. 43.2 Building a Positive Work Culture A positive work culture promotes productivity and employee satisfaction. This section explores strategies for building a positive work culture within the Bureau De Change business. It includes initiatives such as open communication channels, teamwork, work-life balance programs, professional development opportunities, and a supportive management style. It emphasizes the importance of creating an inclusive and empowering work environment. Chapter 44: Monitoring and Evaluating Key Performance Indicators 44.1 Defining and Tracking Performance Metrics Tracking key performance indicators (KPIs) is essential for monitoring the Bureau De Change business's performance. This section discusses the process of defining and selecting relevant KPIs based on the business's goals and objectives. It covers metrics such as transaction volume, revenue growth, customer acquisition cost, customer satisfaction, and employee productivity. It emphasizes the regular monitoring of KPIs to track progress and make data-driven decisions. 44.2 Regular Evaluation and Adjustment of Business Strategies Based on the KPIs and performance analysis, this section explores the process of evaluating and adjusting business strategies. It discusses the importance of periodic reviews, identifying areas for improvement, and implementing necessary changes to optimize business performance. It emphasizes the value of agility and adaptability to maintain a competitive edge in the Bureau De Change industry. Chapter 45: Customer Data Protection and Privacy 45.1 Compliance with Data Protection Regulations Protecting customer data is a legal and ethical responsibility for the Bureau De Change business. This section discusses the importance of complying with data protection regulations, such as the General Data Protection Regulation (GDPR) or local privacy laws. It covers strategies for data security, customer consent management, data breach response planning, and employee training on data protection best practices. 45.2 Securing Customer Data and Privacy Measures To ensure customer data security and privacy, this section outlines measures for securing customer data. It includes practices like data encryption, access control protocols, regular data backups, and network security measures. It also emphasizes the importance of transparent privacy policies, data retention policies, and ongoing monitoring of data security systems. Chapter 46: Corporate Governance and Ethical Practices 46.1 Establishing a Strong Corporate Governance Framework Strong corporate governance is essential for the Bureau De Change business's long-term success and sustainability. This section explores strategies for establishing a robust corporate governance framework, including the establishment of a board of directors, transparent decision-making processes, internal control systems, and regular financial reporting. It highlights the importance of upholding ethical practices and maintaining the trust of stakeholders. 46.2 Ethical Considerations in Currency Exchange Operations Ethical considerations are vital in currency exchange operations. This section discusses the ethical responsibilities of the Bureau De Change business, such as providing accurate information to customers, avoiding deceptive practices, and complying with regulations to prevent money laundering and terrorist financing. It emphasizes the importance of maintaining high ethical standards to protect the business's reputation and build trust with customers. Chapter 47: Customer Education and Financial Literacy 47.1 Promoting Financial Literacy and Awareness Promoting financial literacy and awareness among customers is a value-added service for the Bureau De Change business. This section explores initiatives to educate customers about currency exchange, foreign exchange risks, travel budgeting, and ways to protect against currency fluctuations. It may include online resources, educational materials, or workshops to empower customers and enhance their financial decision-making capabilities. 47.2 Providing Currency Exchange Tips and Travel Advice To assist customers, this section provides currency exchange tips and travel advice. It covers topics like understanding exchange rates, avoiding common pitfalls in currency exchange, using prepaid travel cards, and managing finances while traveling. By offering valuable information, the Bureau De Change business enhances the customer experience and establishes itself as a trusted source of guidance. Chapter 48: Social Media and Online Reputation Management 48.1 Leveraging Social Media Platforms Social media platforms offer opportunities for the Bureau De Change business to engage with customers and build an online presence. This section explores strategies for leveraging social media platforms such as Facebook, Instagram, Twitter, or LinkedIn. It discusses content creation, community engagement, customer support, and reputation management on social media to enhance brand visibility and customer relationships. 48.2 Online Reputation Management Maintaining a positive online reputation is crucial for the Bureau De Change business. This section discusses strategies for online reputation management, including monitoring online reviews, addressing customer feedback promptly and professionally, and proactively managing the business's online presence. It emphasizes the importance of maintaining a strong reputation to attract and retain customers in the digital age. Chapter 49: Continuous Learning and Professional Development 49.1 Promoting Continuous Learning Culture Continuous learning and professional development are essential in the Bureau De Change industry. This section explores strategies for promoting a culture of continuous learning within the business. It includes initiatives such as providing training opportunities, supporting certifications and professional memberships, encouraging knowledge sharing, and staying updated with industry trends and regulatory changes. Continuous learning enhances employee skills and keeps the business competitive. 49.2 Industry Participation and Networking Active industry participation and networking offer valuable opportunities for the Bureau De Change business. This section discusses the benefits of participating in industry associations, attending conferences, seminars, or workshops, and engaging in networking events. It highlights the value of exchanging knowledge, building professional relationships, and staying connected with industry peers to foster growth and stay informed about industry developments. Chapter 50: Future Outlook and Growth Strategies 50.1 Anticipating Future Trends and Market Dynamics This section explores the future outlook of the Bureau De Change industry and the potential trends and market dynamics that may shape its evolution. It may include discussions on emerging technologies, changing customer preferences, regulatory shifts, and geopolitical factors impacting currency exchange. Understanding future trends helps the business proactively adapt and implement growth strategies. 50.2 Strategies for Sustained Growth and Market Leadership To achieve sustained growth and market leadership, this section outlines strategies for the Bureau De Change business. It may include expanding service offerings, entering new markets, investing in technological advancements, optimizing operational efficiency, enhancing customer experience, and fostering strategic partnerships. The strategies align with the business's long-term vision and position it for continued success in the dynamic currency exchange industry.

Featured books

Buy at Amazon

Return to Home Page

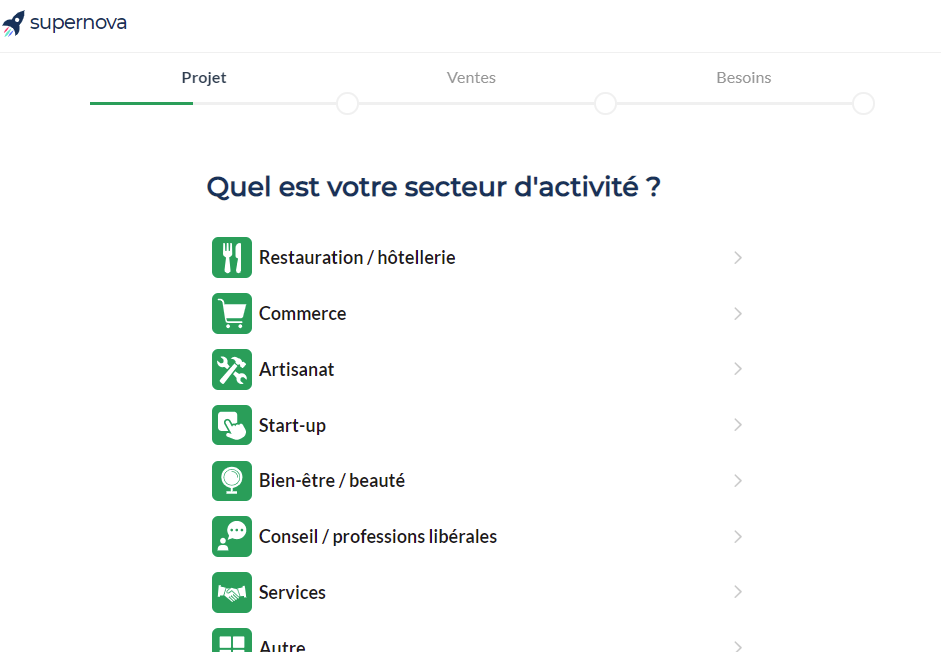

Besoin d'un modèle de Business plan pour votre projet de bureau de change

Chez Supernova, nous vous proposons de créer votre business plan pas à pas grâce à une application simple, rapide et intuitive. Pour être remarquable, osez vous démarquer !

Il existe beaucoup de solutions, mais elles ne sont pas toujours adaptées...

- Modèles à télécharger

- Outils financiers

Les modèles sont souvent des cadres qu’on essaye d’imposer à tout le monde, alors que chaque projet d’entreprise est unique. Du coup, on se retrouve à compléter des sections dont on a pas toujours besoin et à faire des calculs qui ne nous correspondent pas. Aussi, on passe beaucoup de temps dessus alors qu’on aurait d’autres choses à faire.

On ouvre un document Word et/ou Excel censé nous aider à calculer notre rentabilité, à créer nos états financiers, notre business plan… et on se retrouve avec une usine à gaz inexploitable. On ne sait pas à quoi correspond chaque chiffre, le document ne correspond pas à notre projet et on ne comprend pas comment le présenter.

Viennent alors les outils du monde de la finance, souvent très chargés en fonctionnalités et pas toujours adaptés à la création de business plan. Logiciels souvent incompris et onéreux du fait de leurs multiples activités, ils proposent des fonctions de facturation tout comme de comptabilité, et sont pour nous totalement surdimensionnés.

C’est pour cela que nous avons crée SUPERNOVA

Un outil simple pour créer son business plan.

Questionnaire personnalisé

Simulateur de rentabilité, scoring de votre projet, modèles et données intelligentes, exports financiers et business plan.

Prêt à décoller ? C'est simple, rapide, intuitif

Vous souhaitez ouvrir un bureau de change .

Vous possédez déjà une solide expérience dans le secteur de la banque et de la finance et disposez de bonnes connaissances sur la transaction des devises. Vous envisagez désormais d’ouvrir votre propre bureau de change. En élaborant un business plan avant la création de votre entreprise, vous mettez toutes les chances de votre côté pour garantir son succès.

Ce document doit déterminer toutes les étapes à suivre et prévoir vos obligations : analyse du marché, autorisation d’exercer par l’ACPR, capital de départ, enregistrement de la société, services de change (euro, dollar…), stratégie d’entreprise, marketing, vente de produits annexes…

Pour convaincre les investisseurs de vous accorder un financement, vous devrez présenter un business plan solide et pertinent. Les modèles à télécharger gratuitement sur Internet sont souvent généralistes et inadaptés. Optez plutôt pour la solution Supernova, un business plan sur mesure pour lancer une activité de bureau de change.

Que doit contenir un bon business plan pour la création d’un bureau de change ?

Pour vous aider à concevoir un modèle de prévisions financières solides pour votre projet de bureau de change, nous vous détaillons ici nos bonnes pratiques pour élaborer un plan de développement qui vous sera vraiment utile.

Parce que vous avez besoin de convaincre les entreprises partenaires, la banque, les investisseurs et d’avoir une vision claire de vos objectifs, prenez le temps de lire attentivement la méthode inédite Supernova : les prévisions financières avant la rédaction du business plan.

Parce que votre pitch, l’explication de votre étude de marché, toute cette partie qui concerne votre idée de bureau de change est ce qui vient après l’aspect concret. À savoir :

- Qu’est-ce que je vends ? Quelles devises [euro, dollar…] ? Quels moyens de paiement ? Autres services et produits [réservation de devise, travellers chèques] ?

- A qui ? Est-ce que je cible des touristes qui viennent en vacances ? Est-ce que je m’adresse à des nationaux qui voyagent ?

- Combien ? Quels taux de change appliquez-vous ? Quels frais d’opération ? À combien s’élève votre commission ?

- En quelles quantités ? Combien de devises proposer ? Y a-t-il un montant minimum ou maximum ? Combien de bureaux de change ouvrir ?

- Combien ça me coûte ? Acquisition d’un local, capital et ressources investis, recrutement d’une équipe, prix d’achat des devises, réservation en ligne…

En d’autres termes : testez par les chiffres votre modèle d’entreprise, avant de vouloir la mettre en forme et de la présenter dans votre business plan.

Contrairement à d’autres méthodes, chez Supernova, nous recommandons de commencer par l’analyse prévisionnelle financièrequi vous permet d’avoir une vision claire et palpable de votre projet d’ouverture de bureau de change. Cette analyse préliminaire vous renseigne immédiatement sur la viabilité de votre entreprise et de son modèle d’affaires. Vous y parlerez plan de financement, bilan, compte de résultat. C’est cela qui vous apportera tous les éléments nécessaires pour pouvoir détailler ensuite votre business plan sur la partie rédactionnelle.

Pour créer la partie délicate du modèle de prévisions financières, nous vous recommandons une approche lucide. Distinguez nettement tout ce qui est incertain (le chiffre d’affaires de votre entreprise de change et tout ce qui le compose) de ce qui est certain (vos dépenses, investissements et ressources de départ, salaires, coûts unitaires, etc.)

Cela vous permettra de vérifier en un coup d’œil le chiffre d’affaires minimum que vous allez devoir effectuer, et celui qui vous permettra de commencer à bien vivre de votre activité.

À Supernova, on soutient les projets d’entreprises qui facilitent les échanges de devises entre les pays et simplifient les déplacements internationaux. Mais on est raisonnable : on vous conseille d’être le plus pessimiste possible, prudent et pragmatique avant la rédaction de votre business plan. Nous croyons en vous et en la réussite de votre modèle d’affaires, mais mieux vaut sous-évaluer de 10 % vos prix et surévaluer vos coûts de 20 % pour n’avoir que de bonnes surprises.

Certains équipements pour votre projet d’entreprise ne sont pas immédiatement nécessaires, ou vous allez pouvoir vous les offrir dans une version plus abordable. Ne prévoyez donc pas les meilleurs équipements pour le début de votre activité, juste ceux dont vous avez besoin pour satisfaire vos clients avec des services de qualité !

Plus en détail, la partie financière de votre business model pour votre projet de bureau de change va demander :

De lister vos produits ou services (retrait d’argent en devises étrangères, service de réservation de devises, offre sur mesure…) que vous vendez, avec le prix unitaire (en coûts directs) tout en parlant hors taxes (toujours !).

De lister vos dépenses liées au lancement et frais récurrents (les dépenses fixes) : loyer, frais bancaires, conseil juridique, etc. Listez vos investissements, les salaires de votre équipe, les apports faits par les investisseurs (vous, par exemple !) sans oublier les emprunts.

Prenez votre temps et assurez-vous de ne rien oublier avant la rédaction de votre business plan ! Vous allez utiliser tout cela pour calculer un seuil de rentabilité sur lequel vous baserez toute votre activité. D’où l’intérêt d’être pessimiste dans ses coûts/frais et ses gains/ventes. Lorsque l’on est en pleine création d’une entreprise, il ne faut pas se laisser (trop) griser par l’excitation de l’idée.

Seuls les chiffres sont fiables et vous permettront de bâtir une vraie stratégie d’entreprise pour monter votre projet !

Maintenant que votre modèle de prévisions financières est bien calibré et dans votre tête, vous allez facilement pouvoir détailler votre business plan. Vous savez déjà combien vous devez générer de chiffre d’affaires pour couvrir vos dépenses et vous verser un salaire.

Vous avez besoin de présenter votre projet d’entreprise pour convaincre les futurs investisseurs et partenaires du succès de votre modèle d’affaires.

Que cela soit pour créer un business plan pour votre nouveau projet de bureau de change ou pour la création d’un site internet de vente en ligne de devises étrangères, votre modèle va être le suivant :