An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock Locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Hurricanes Helene and Milton

Need help? Learn about SBA disaster assistance.

Market research and competitive analysis

Use market research to find customers.

Market research blends consumer behavior and economic trends to confirm and improve your business idea.

It’s crucial to understand your consumer base from the outset. Market research lets you reduce risks even while your business is still just a gleam in your eye.

Gather demographic information to better understand opportunities and limitations for gaining customers. This could include population data on age, wealth, family, interests, or anything else that’s relevant for your business.

Then answer the following questions to get a good sense of your market:

- Demand: Is there a desire for your product or service?

- Market size : How many people would be interested in your offering?

- Economic indicators: What is the income range and employment rate?

- Location: Where do your customers live and where can your business reach?

- Market saturation: How many similar options are already available to consumers?

- Pricing: What do potential customers pay for these alternatives?

You’ll also want to keep up with the latest small business trends. It’s important to gain a sense of the specific market share that will impact your profits.

You can do market research using existing sources, or you can do the research yourself and go direct to consumers.

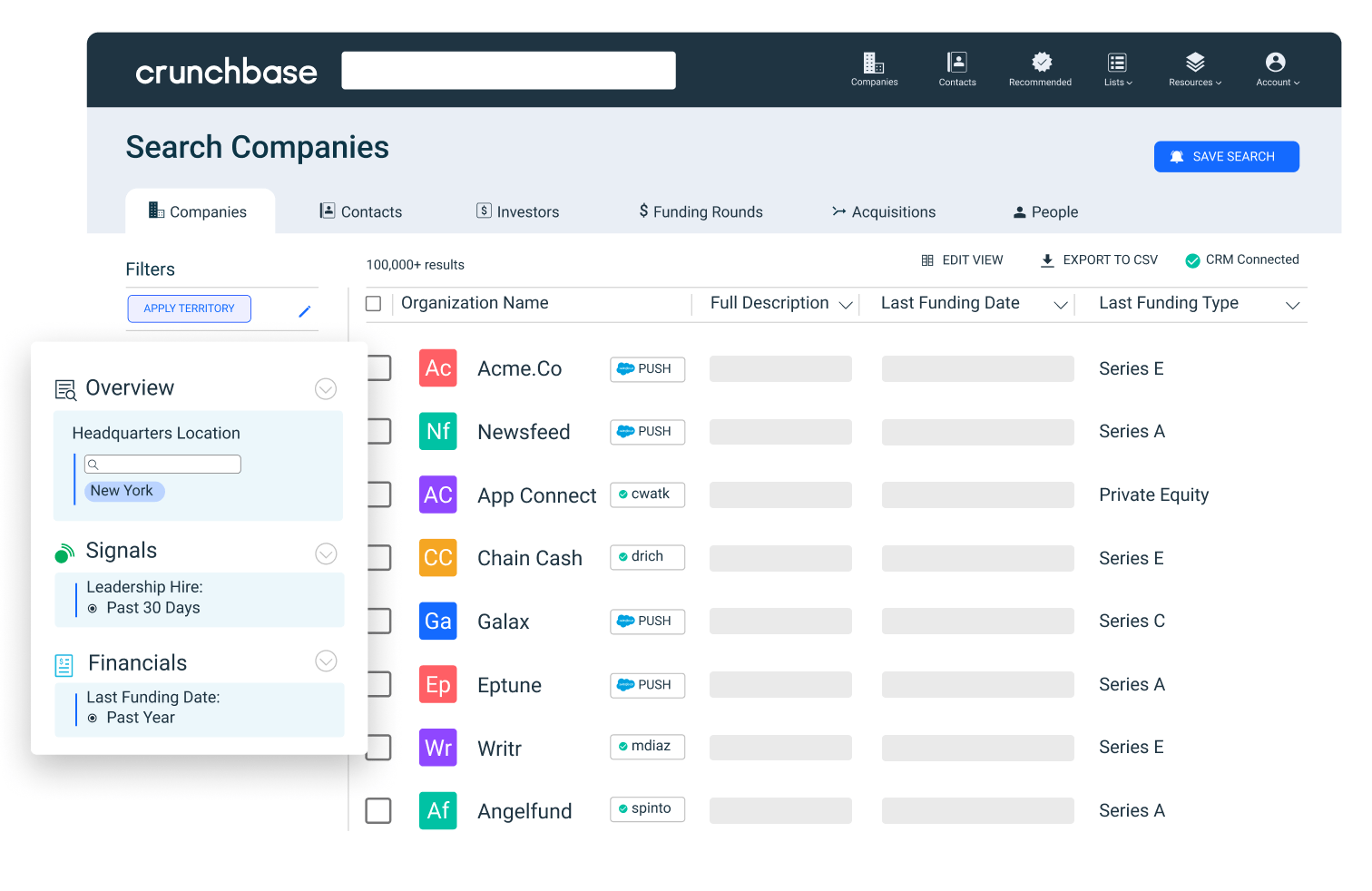

Existing sources can save you a lot of time and energy, but the information might not be as specific to your audience as you’d like. Use it to answer questions that are both general and quantifiable, like industry trends, demographics, and household incomes. Check online or start with our list of market research resources .

Asking consumers yourself can give you a nuanced understanding of your specific target audience. But, direct research can be time consuming and expensive. Use it to answer questions about your specific business or customers, like reactions to your logo, improvements you could make to buying experience, and where customers might go instead of your business.

Here are a few methods you can use to do direct research:

- Questionnaires

- Focus groups

- In-depth interviews

For guidance on deciding which methods are worthwhile for your small business, the U.S. Small Business Administration (SBA) provides counseling services through our resource partner network .

Use competitive analysis to find a market advantage

Competitive analysis helps you learn from businesses competing for your potential customers. This is key to defining a competitive edge that creates sustainable revenue.

Your competitive analysis should identify your competition by product line or service and market segment. Assess the following characteristics of the competitive landscape:

- Market share

- Strengths and weaknesses

- Your window of opportunity to enter the market

- The importance of your target market to your competitors

- Any barriers that may hinder you as you enter the market

- Indirect or secondary competitors who may impact your success

Several industries might be competing to serve the same market you’re targeting. Important factors to consider include level of competition, threat of new competitors or services, and the effect of suppliers and customers on price. Learn more in the Strategic Marketing Journey on MySBA Learning .

Free small business data and trends

There are many reliable sources that provide customer and market information at no cost. Free statistics are readily available to help prospective small business owners.

Consider the following federal business statistics in your market research and competitive analysis:

Need help? Get free business counseling

The Ultimate Guide to Market Research for Small Businesses

- Updated on June 26, 2024

Starting a business is an exciting venture but also a challenging one. One of the most crucial steps in this journey is conducting thorough market research. Understanding your market is key to making informed decisions, developing effective strategies, and ultimately achieving success. In this ultimate guide, we’ll explore why market research is essential, how to do it, the tools you’ll need, and how prelaunch activities can offer valuable insights.

Why You Need to Conduct Market Research

Imagine launching a product or service into a black box. You have no idea who your ideal customer is, what their needs are, or even if there’s a market for what you’re offering. Yikes! This is where market research comes in.

Think of market research as your business’s roadmap to success. By gathering data and insights about your target audience and the competitive landscape, you can make informed decisions about everything from product development to marketing strategies. Here are some key reasons why market research is essential:

Know Your Customer: Understanding your target audience’s demographics, needs, preferences, and buying behaviors allows you to tailor your offerings directly to them.

Identify Opportunities: Market research can reveal gaps in the market or unmet customer needs. This can spark innovative ideas for new products or services.

Stay Competitive: Knowing your competition’s strengths and weaknesses helps you differentiate your brand and develop a winning strategy.

Reduce Risk: Market research can help you identify potential challenges before you invest heavily in product development or marketing campaigns.

Measure Success: By tracking market trends and customer feedback, you can gauge the effectiveness of your strategies and make adjustments as needed.

In short, market research is an investment that can pay off significantly. It equips you with the knowledge and insights you need to navigate the ever-changing marketplace and achieve sustainable growth.

How to Do Market Research for a Small Business

So, you’re convinced of the importance of market research, but where do you begin? This step-by-step guide will equip you with the tools to conduct effective market research on a budget:

Step 1: Define Your Research Goals

Before diving in, identify what you want to achieve. Are you trying to understand customer needs for a new product? Maybe you want to analyze the effectiveness of your current marketing strategy. Having clear goals keeps your research focused and helps you choose the most relevant methods.

Step 2: Leverage Secondary Research (Free or Low-Cost)

Secondary research involves utilizing existing data collected by others. This is a fantastic way to gain a broad understanding of your market landscape without breaking the bank. Here are some resources:

Government Websites: The U.S. Small Business Administration provides a wealth of free market research tools and industry reports.

Industry Associations: Many industry associations publish reports and data on market trends, demographics, and competitor analysis. Consider the list below as a starting point and adjust it based on your particular niche:

American Marketing Association (AMA)

- Focus: Marketing trends, consumer behavior, and advertising effectiveness.

- Publications: Journal of Marketing , Marketing News

National Retail Federation (NRF)

- Focus: Retail industry trends, consumer behavior, and sales data.

- Publications: NRF Retail Sales Report , Consumer View

International Data Corporation (IDC)

- Focus: Technology market trends, IT spending, and competitive analysis.

- Publications: Worldwide Quarterly PC Tracker , IT Market Reports

Consumer Technology Association (CTA)

- Focus: Consumer electronics and technology trends.

- Publications: Consumer Technology Ownership and Market Potential Study

National Association of Realtors (NAR)

- Focus: Real estate market trends, housing statistics, and buyer/seller demographics.

- Publications: Existing Home Sales , NAR Profile of Home Buyers and Sellers .

Biotechnology Innovation Organization (BIO)

- Focus: Biotechnology industry trends, research and development, and market data.

- Publications: BIO Industry Analysis Reports , Emerging Therapeutic Company Investment Report .

Gartner, Inc.

- Focus: Technology market trends, IT spending, and strategic insights.

- Publications: Gartner Magic Quadrant

World Travel & Tour i sm Council (WTTC)

- Focus: Global travel and tourism trends, economic impact, and market analysis.

- Publications: WTTC Economic Impact Reports , Travel & Tourism Competitiveness Report .

Food Marketing Institute (FMI)

- Focus: Food retail industry trends, consumer shopping behavior, and sales data.

- Publications: The Food Retailing Industry Speaks , U.S. Grocery Shopper Trends .

Association for Computing Machinery (ACM)

- Focus: Computing and IT industry trends, research developments, and technological advancements.

- Publications: Communications of the ACM, ACM Transactions on Computer Systems

International Council of Shopping Centers (ICSC)

Focus: Shopping center industry trends, retail real estate, and consumer behavior.

Publications: ICSC Research Reports , Shopping Centers: America’s First and Foremost Marketplace .

Market Research Reports: Public libraries often offer access to subscription-based market research databases, allowing you to download relevant reports. Visit your local library to find out what resources they have.

Step 3: Conduct Primary Research to Gather Specific Insights

Secondary research provides a foundation, but primary research allows you to delve deeper into your target audience’s thoughts and behaviors. Here are some cost-effective methods to consider:

Online Surveys: Free survey tools like Google Forms or SurveyMonkey allow you to gather feedback from a large pool of potential customers. Keep your surveys concise and easy to complete to ensure a high response rate.

Social Media Listening: Tools like Brandwatch or Hootsuite allow you to track conversations about your industry or brand on social media platforms. This can reveal valuable insights into customer sentiment and preferences. Also consider using this AI Market Research tool that gathers information on competitor products from Amazon, analyzes their feedback, and gives you a summary with all the juicy details that will help you create a product your customers will love.

Focus Groups: Gather a small group of potential customers for a moderated discussion about your product, service, or industry. This allows for in-depth exploration of their thoughts and experiences. For more information on conducting focus groups, click here .

Pro tip: Gathering primary resources is easier said than done, so we recommend on using tools that pool the resources for you. For example, when it comes to online surveys Prelaunch is a concept validation platform that lets you develop a landing page to test the waters for a product your considering on selling.

Here, you’ll see how people react, what comments they have, if there is adequate market demand, and even how much people are willing to pay. A quick embedded survey is posed both to those who showed interest in your product and – wait for it – those who were even willing to pay a special price for it before you created it.

Step 4: Analyze Your Findings and Draw Conclusions

Once you’ve collected your data, it’s time to make sense of it all. Organize your findings from both secondary and primary research. Look for patterns, trends, and recurring themes. What do these insights tell you about your target market and your competitive landscape?

Not sure you have time for all that? You’re not the only one. That’s why Prelaunch compiles all the info derived from your primary sources into a single Dashboard that clearly breaks down who your customers are and what they want.

Step 5: Take Action and Refine

Use your market research to inform your business decisions. This could involve modifying your product or service offering, developing targeted marketing campaigns, or adjusting your pricing strategy. Remember, market research is an ongoing process. As your business evolves, revisit your research and adapt your strategies based on new data and market trends.

That’s why we always say Prelaunch as soon as possible. Even if you only have quality rendered images of your product, imagine how much your prototype could improve if your customers pointed out your blind spots beforehand. Having a landing page that interested people visit and tracking what they have to say is a solid place to start from.

Market Research Tools for Small Businesses

Several tools can simplify and enhance your market research efforts. Here are some must-haves for small businesses:

Survey Tools

- SurveyMonkey : A popular and easy-to-use tool that allows you to create surveys, quizzes, and polls. It offers a free plan with limited features and paid plans with more advanced features such as branching logic and skip logic.

- Typeform : Another user-friendly survey tool that allows you to create visually appealing surveys. It offers a free plan with limited features, and paid plans with more advanced features such as logic jumps and custom branding.

- Prelaunch : The platform does not have surveys as a separate feature per say, but rather makes a few targeted question an embedded part of the process when users visit a product’s landing page.

- Google Forms : A free survey tool from Google that is easy to use and integrates seamlessly with other Google products. It is a good option for simple surveys with a limited number of questions.

Social Media Listening Tools

- Brandwatch : A powerful social listening tool that allows you to track brand mentions, analyze sentiment, and identify influencers. It offers a free trial, but paid plans are required for access to most features.

- Hootsuite : A social media management tool that also offers social listening capabilities. It allows you to track brand mentions, analyze sentiment, and schedule social media posts. It offers a free plan with limited features, and paid plans with more advanced features.

- AI Market Research Tool by Prelaunch : This tool can analyze thousands of reviews and feedback on Amazon to uncover the top customer praises and complaints.

- Sprout Social : Another social media management tool that offers social listening capabilities. It allows you to track brand mentions, analyze sentiment, and engage with customers on social media. It offers a free trial, but paid plans are required for access to most features.

Website Analytics Tools

- Google Analytics : A free website analytics tool from Google that provides insights into website traffic, user behavior, and conversions. It is a must-have tool for any small business with a website.

- Hotjar : A website heatmap and analytics tool that allows you to see how visitors are interacting with your website. It offers a free plan with limited features, and paid plans with more advanced features such as session recordings and form analytics.

- Crazy Egg : Another website heatmap and analytics tool that allows you to see how visitors are interacting with your website. It offers a free trial, but paid plans are required for access to most features.

- Ahrefs : A powerful SEO tool that allows you to track keywords, analyze backlinks, and conduct competitor analysis. It offers a free trial, but paid plans are required for access to most features.

- SEMrush : Another powerful SEO tool that offers similar features to Ahrefs. It offers a free trial, but paid plans are required for access to most features.

- Moz : An SEO tool that offers a variety of features, including keyword research, backlink analysis, and on-page optimization tools. It offers a free plan with limited features, and paid plans with more advanced features.

These are just a few of the many market research tools available for small businesses. The best tool for you will depend on your specific needs and budget. Be sure to research different tools and compare features before making a decision.

Conducting market research is a vital step for small businesses and entrepreneurs. It provides the data and insights needed to make informed decisions, understand your target audience, identify opportunities, and gain a competitive advantage. By following the steps outlined in this guide and utilizing the recommended tools, you can conduct effective market research and set your business up for success.

Remember, market research is an ongoing process. Continuously gather and analyze data to stay ahead of trends and adapt to changing market conditions. And don’t forget to leverage prelaunch activities to refine your product and marketing strategies.

1. What is market research?

Market research is the process of gathering information about your target market, competitors, and the overall industry landscape. This information can be used to make informed business decisions about everything from product development and pricing to marketing strategies and sales tactics.

2. Why is market research important?

Market research is crucial for small businesses because it helps you:

- Understand your customers: Identify their needs, preferences, and buying behaviors.

- Identify opportunities: Discover gaps in the market or unmet customer needs that your business can address.

- Stay competitive: Analyze your competition’s strengths and weaknesses to differentiate your brand and develop a winning strategy.

- Reduce risk: Make informed decisions to avoid costly mistakes in product development or marketing campaigns.

- Measure success: Track market trends and customer feedback to gauge the effectiveness of your strategies and make adjustments as needed.

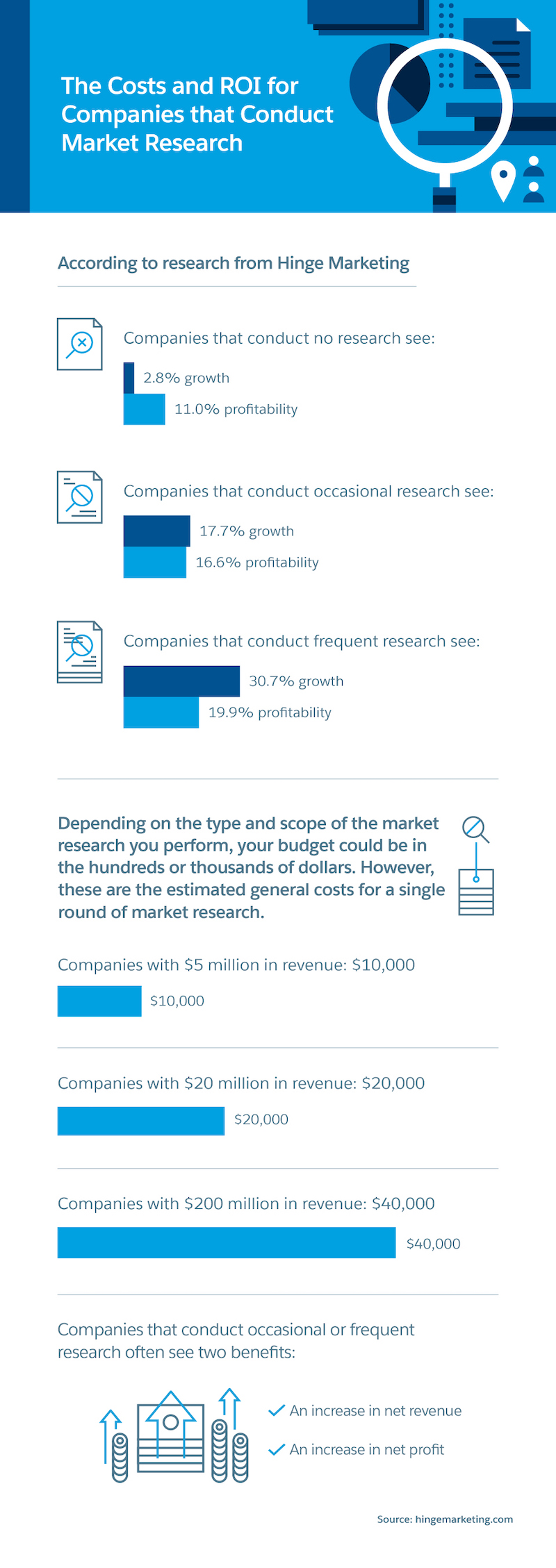

3. How much does market research cost for a small business?

Market research can be conducted on a budget. Here’s a breakdown of costs:

- Free or Low-Cost Options: Utilize free government resources, industry reports, and online survey tools like Google Forms.

- Moderate Cost: Consider social listening tools with free trials or student research partnerships with universities. Another option is to use tools that combine things like social listening and primary research in one like Prelaunch.

- Higher Cost: Invest in professional market research agencies for in-depth studies, but this might not be necessary for every small business.

Remember, effective market research doesn’t have to be expensive. By being resourceful and focusing on your specific needs, you can gain valuable insights to propel your small business forward.

4. What are some common market research methods for small businesses?

Secondary Research: Leverage existing data from government websites, industry associations, and market research reports.

Surveys & Online Polls: Gather feedback from a large pool of potential customers through free survey tools.

Social Media Listening: Track brand mentions and analyze customer sentiment on social media platforms.

Focus Groups: Conduct moderated discussions with a small group of potential customers to gain in-depth insights.

Website Analytics: Utilize tools like Google Analytics to understand website traffic, user behavior, and conversions.

Related Articles

Automotive Market Research: Specifics, Challenges, and Tips

- by Alice Ananian

- Updated on June 5, 2024

Mastering Open-Ended Questions: Definition, Types, and Examples

- Updated on August 22, 2024

12 Free Ways to Do Market Research for Small Business

DAVID FAČKO

October 9, 2023

In the business world, market research is your compass. It guides you toward understanding your customers, competition, and industry trends. While larger corporations may have ample resources for comprehensive research, as a small business owner, you need cost-effective strategies to gain valuable insights and stay competitive.

This guide is tailored to small business owners searching for cost-effective market research methods. By combining these strategies, you can empower your small business with the knowledge needed to flourish in an ever-competitive market.

Dive deep into our comprehensive guide on establishing a successful startup , offering insights, tips, tools and best practices to ensure your venture thrives in today’s competitive landscape.

Ready? Let’s dive into 12 insightful market research methods that will help your small business to thrive without breaking the bank. Contents hide Market Research Ideas On A Budget 1. Create Online Surveys 2. Utilize Social Listening 3. Explore Competitor Analysis 4. Tap into Public Data Sources 5. Engage in Online Communities 6. Leverage Email Surveys 7. Attend Virtual Trade Shows and Webinars 8. Monitor Website Analytics 9. Encourage Online Reviews 10. Act on Customer Feedback 11. Partner with Local Business Associations 12. Tap into Academic Resources Integrating Invoicing for Enhanced Customer Engagement Conclusion Stay a stride ahead of your competitors with Billdu!

Market Research Ideas On A Budget

1. create online surveys.

Creating online surveys using free tools like Google Forms or SurveyMonkey is an easy way to crowdsource input and opinions and gather valuable data. Ask your existing customers about their preferences, needs, and pain points and if there are ways, they think you can improve. It’s a great idea to add links to these surveys in your invoices to encourage feedback, helping you to refine your offerings. You can easily start with survey templates .

Not certain how to draw in new customers ? Check out our article for guidance.

2. Utilize Social Listening

Social listening or social media listening is exactly what it sounds like. You can monitor conversations on social media platforms related to your industry or niche to see what people say about your business, pricing, service, and everything else. Tools like Mention and Hootsuite can help you track brand mentions and customer sentiment to gain insight into market trends and customer preferences.

3. Explore Competitor Analysis

Your business shouldn’t exist in a bubble, and keeping tabs on your competitors is an easy way to do market research that costs nothing more than your time. Analyze your competitors’ websites, social media profiles, and customer reviews to see what they’re doing well and where they’re falling short. This information can inform your business strategies and customer engagement techniques.

4. Tap into Public Data Sources

Government websites, industry publications, and libraries offer a wealth of free data. Research demographic trends, economic indicators, and market statistics specific to your area or industry to see where there are gaps or potentially spot any problems.

Steer clear of the most common mistakes startups make .

5. Engage in Online Communities

Joining online forums, groups, or communities where your target audience is can be a good way to learn more about them. Make time to participate in discussions, ask questions, and observe what matters most to potential customers to better understand their pain points and needs, and how you can meet them.

6. Leverage Email Surveys

Your email list is a valuable asset for market research. Send out short surveys to your subscribers, asking for their opinions on your products or services. To encourage participation, you can offer incentives like discounts or exclusive content. Your invoices can also include links to these surveys, making it convenient for customers to provide feedback.

The pricing strategy for your products and services plays a crucial role in your business’s success. It’s a valuable piece of information that can greatly influence purchasing decisions. To ensure you’re on the right track, consider seeking feedback from your customers about your pricing structure and any potential adjustments.

7. Attend Virtual Trade Shows and Webinars

In the last few years, many industries have shifted to virtual events . Attending webinars, virtual trade shows, or industry-specific online conferences provide insights into the latest trends, consumer preferences, and emerging technologies. You can also engage with speakers and fellow attendees to gather valuable market intelligence and learn more from professionals in your field.

8. Monitor Website Analytics

Free tools like Google Analytics are incredibly valuable, as you can use them to track user behavior on your website. Analytics tools allow you to analyze which pages receive the most traffic, where visitors drop off, and which products or services generate the most interest. This data can guide your website improvements and marketing strategies.

In fact cloud-based website monitoring is an excellent holistic option that keeps customers engaged with your online presence by ensuring you can provide a consistent experience whenever they visit your site. Having a direct line to performance data lets you minimize downtime, pinpoint and troubleshoot issues efficiently, and enhance the security of your site so that user trust is preserved.

9. Encourage Online Reviews

A staggering 98% of people look at online when looking up local businesses. But reviews don’t just benefit customers, they benefit your business too. You can think of online reviews as free market research as they tell you what you’re doing right—or wrong. List your business on Google My Business, Yelp, Facebook, and as many other platforms as you can find that are relevant to your customer base. Keep a close eye on how people rate you and what they say, and always respond, whether the feedback is positive or negative.

10. Act on Customer Feedback

After gathering feedback, you must act on the insights you receive. You can use the data to improve your products, services, or customer experience, and you let customers know you’ve done so. It’s easier to analyse customer feedback with AI and, after that, you can use the data to improve your products, services, or customer experience, and you let customers know you’ve done so. This proactive approach not only demonstrates your commitment to your customers but also fosters loyalty and trust.

Additionally, consider exploring outsourcing for startups to efficiently leverage external expertise in areas like customer support or data analysis, allowing your team to focus on core competencies and overall business growth.

11. Partner with Local Business Associations

Joining local business associations or chambers of commerce can provide access to valuable market data and networking opportunities. These organizations often conduct surveys or share industry reports that can benefit your business. Additionally, networking with fellow business owners can lead to informal market insights and collaborations. Staying active in your local business community helps you to stay informed and connected.

12. Tap into Academic Resources

Many universities and colleges have research departments that conduct studies on various industries and market trends. Reach out to academic institutions in your area and inquire about available research reports or partnership opportunities. Collaborating with academic researchers can provide access to valuable data and expertise to inform your business decision, and it won’t cost you a cent.

Numerous studies delve into the business environment, including those that focus on remote work statistics .

Integrating Invoicing for Enhanced Customer Engagement

As you explore these cost-effective market research strategies, consider integrating invoicing as part of your customer engagement efforts. Billdu, known for its efficient invoicing features , can help you achieve this by including a survey link in your invoices.

Imagine attaching a simple survey at the end of your invoices, asking customers for feedback on their recent purchases or overall experience with your business. This approach not only demonstrates your commitment to customer satisfaction but also provides you with direct, actionable insights. You can inquire about product preferences, service quality, or suggestions for improvement.

By combining market research with invoicing, you’re creating a seamless feedback loop that not only benefits your customers but also empowers your business to make data-driven decisions. Invoicing becomes more than just a transaction; it becomes an opportunity to strengthen customer relationships and gather valuable market insights.

In the competitive landscape of small businesses, being resourceful is key. With these cost-effective market research strategies and the integration of invoicing for enhanced customer engagement, you’ll be well-equipped to navigate the ever-evolving market and position your small business for growth and success.

Stay a stride ahead of your competitors with Billdu!

Integrating invoicing can significantly boost customer engagement, streamlining the billing process and ensuring timely communications. Try Billdu today to simplify your transactions, foster trust, and elevate the overall customer experience.

SEO Specialist at Billdu

David Fačko is an SEO specialist at Billdu, one of the best-rated invoicing software for freelancers in the world.

Fake Invoice: How to Protect Your Business

How to make an invoice in excel, related posts.

How to Convert Your Estimates into an Invoices

What Is Recurring Billing? Definition, Types, & Expert Tips

How to Improve Your Business Efficiency

Step-by-Step Guide: Creating Custom Receipt Templates

10 Best Small Business Accounting Software in Australia for 2025

10 Best Invoicing Software in Australia of 2025

Enjoy 20% off.

Sign up now for a 30-day free trial and get 20% off on your first subscription

By signing up you agree to Terms of use and Privacy policy

Small Business Marketing

Market Research: A Strategic Advantage for Small Businesses

- Wednesday, November 08, 2023

Market research should be a top priority if you run a small business. Properly understanding your clients and competitors can mean the difference between struggling to get by and positioning your company for growth and profits.

What Does Market Research Involve?

Market research is gathering and analyzing information about your industry, clients, and competitors in order to make smarter strategic decisions. It involves both:

- Primary research : Directly collecting data yourself through methods like surveys, interviews, and focus groups.

- Secondary research : Leveraging outside data sources like industry reports, census data, and news articles.

Here are some of the common goals and focus areas of market research for small businesses:

Infographic

- Identify target client demographics : This could include gathering data on age, gender, location, income level, education, interests, and buying habits. Surveys and analyzing existing sales data can help with this.

- Understand client preferences and values : Conducting focus groups or interviews can provide insights into what styles, brands, prices, quality levels, and features clients prefer. This can inform inventory decisions.

- Assess brand awareness and perception : Surveys can measure clients' familiarity with your brand and their associations or opinions about it. This is useful for positioning and messaging.

- Benchmark competitor prices : Research competitor websites to make comparisons of pricing across products. This can guide decisions on price points.

- Gauge trends : Looking at industry reports can identify the latest and upcoming trends. Allowing small businesses to stay ahead of the curve.

- Identify preferred communication channels : Surveys and social media analytics can provide data on how clients best want to be reached - email, social ads, SMS, etc. This assists in outreach strategy.

- Determine new local target markets : Census data, reader profiles, and web analytics could identify fast-growing areas or segments that represent an opportunity to expand reach.

The Role of Market Research in Small Businesses

The key benefits of market research.

Although conducting market research takes time and effort, it provides several core benefits that can set your small business up for success:

Better Understand Clients

Market research enables you to gain vital insights into your target audience. You can use this data to ensure your offerings match up with clients' needs and expectations. This leads to higher satisfaction.

Assess the Competition

Understanding the competitive landscape is crucial; research reveals competitors' strengths, weaknesses, strategies, and positioning. You can then set your business apart.

Identify Trends and Opportunities

Spot upcoming industry trends through research, allowing you to capitalize on these opportunities. Staying on the pulse of market changes helps you adapt.

Make Smarter Business Decisions

Market research provides the hard data needed to make calculated business decisions and minimize risk. Research ensures you have the facts, whether launching a new product or choosing a store location.

Refine Marketing Strategies

Learn how your audience wants to be reached and what resonates most. Apply these learnings to optimize your outreach across channels for greater success.

Conducting Market Research for Your Small Business

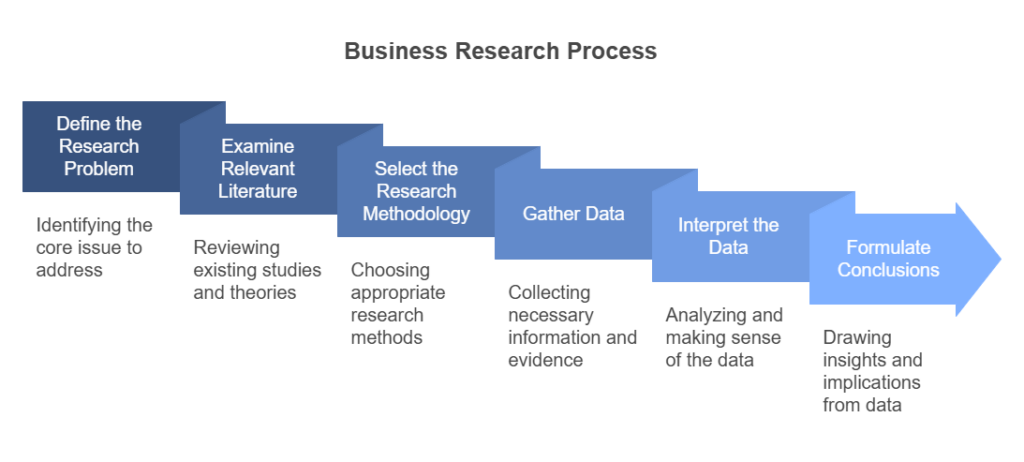

Follow this step-by-step process to carry out market research for your small business:

1. Define Your Research Objectives and Goals

Be very specific here about what information you want to obtain. For example, your objectives could be:

- Understand target client demographics in a potential new market

- Identify the prices competitors charge for high-end products

- Determine client satisfaction levels with your customer service

2. Determine Your Research Methodology

Decide how you will collect data to achieve the objectives. Common methodologies include:

- Surveys - Great for gaining broad feedback from many clients. Could survey website visitors or email clients a questionnaire.

- Interviews - Allows asking follow-up questions for deeper insights. Could interview long-time clients by phone.

- Focus groups - Facilitated discussions with 6-8 people from your target market. Perfect for learning about reactions to new products.

- Third-party data - Leverage existing sources like industry reports, government statistics, and demographics. Low effort but may lack customization.

3. Collect Your Data

Now implement your surveys, interviews, and focus groups or access secondary data sources to gather information. Store the data in an organized format, like a spreadsheet, for the next step.

Example : A bakery owner surveys 100 customers on satisfaction levels with comfort of seating and timeliness of service.

4. Analyze Results

Look at response patterns, averages, highs, and lows. Identify key takeaways and actionable insights from the data.

Example : The bakery owner sees seating satisfaction as low, and times often exceed 10 minutes waiting for orders.

5. Strategize How to Apply Learnings

Determine how your business should respond based on research insights. This could involve changing products, prices, marketing, customer service, and more.

Example : The bakery owner adds more comfortable seating and hires extra staff to improve order speed.

6. Continue Research Regularly

Conduct research on an ongoing basis to keep up with changing client preferences and market dynamics. Quarterly or biannual assessments are recommended.

- Survey clients when they make a purchase in your store or website to gather immediate feedback. Offer a small discount as an incentive.

- Analyze your sales data to identify best-selling products, prices, and client demographics. Look for patterns and insights.

- Regularly monitor review sites to see client feedback on your products, service, and overall experience. Address any complaints.

- Use Google Analytics on your website to see visitor demographics, behavior flow, referral sources, and more.

- Follow social media competitors to spot new product offerings or promotions quickly.

- Use Google Trends to identify rising search terms for which you may want to optimize.

- Partner with a local university marketing department to have students conduct market research projects for your boutique.

- Attend industry trade shows to discover the latest and network with other industry professionals.

- Sign up for industry newsletters and publications to stay on top of trends in your market.

- Use tools like SurveyMonkey or Qualtrics to create and distribute client surveys easily.

- Conduct brief intercept interviews with clients in your store to get quick feedback.

Key Takeaways

When performing market research provides tremendous value to small businesses. It leads to better decision-making, savings from avoiding mistakes, and increased profits by meeting client needs. Following the guidelines above will help you kickstart market research for your company. Now get out there and gain those vital competitive insights!

Written By: Adam Bennett | Wednesday, November 08, 2023

Adam is the president and founder of Cube Creative Design and specializes in private school marketing. Since starting the business in 2005, he has created individual relationships with clients in Western North Carolina and across the United States. He places great value on the needs, expectations, and goals of the client.

- Learn more about Adam Bennett:

- Learn more about Adam Bennett

- Connect with on LinkedIn

- Follow on Facebook

- See more on Instagram

Subscribe To Our Monthly Email Newsletter

Cube Creative sends out helpful emails each month to help you on your journey to better digital marketing. Sign Up Below!

Recent Blog Posts

Ultimate Marketing Guide for Home Service Companies

PPC Management for Small Businesses: Step-by-Step Guide

Improve Local Search Rankings with UX Best Practices

Top 12 Ways to Use Digital Marketing for Small Service Area Businesses

Interested in guest posting here.

Are you interested in having your content show up here?

Check our guidelines

Complete Market Research Guide for Small Businesses

Introduction

Welcome to the vibrant realm of small business, where each decision can shape your success, and understanding your market is key. Whether you're launching a new venture or refining an existing one, grasping what "market research" entails can empower your business journey 🚀. One of the most crucial reasons to prioritize market research is to avoid joining the sobering statistics of small business failures.

According to studies, just over 40% of small businesses fail because there's an insufficient need for their product or service . When demand is lacking, even the best marketing campaigns won't turn around your business results. This is a harsh reality many entrepreneurs face, yet it highlights the transformative power of market research. By understanding your marketplace thoroughly before launching or pivoting your business, you’re more likely to succeed.

Market research is essentially having a conversation with your marketplace. It's about gathering crucial information on customers, competitors, and market dynamics. Imagine having a window into what your customers truly want, what drives them, and even what irritates them—knowledge that enables you to mold your offerings to match their needs, enhancing satisfaction and loyalty.❤️

For small businesses, market research is not merely advantageous; it's essential. It sharpens your decision-making, refines marketing strategies, and fortifies your position against competitors. By engaging in market research, you’ll:

- Detect Trends: Stay ahead by identifying emerging trends, ensuring your offerings remain appealing.🌟.

- Meet Customer Needs: Gain insights into customer desires and tailor solutions to exceed expectations.🌈

- Reduce Risks: Make informed choices that decrease uncertainty and financial risks associated with new ventures.💡

- Understand Competitors: Learn from competitors and uncover market gaps to exploit.

The best part? Thanks to today's technological advancements, small businesses can perform effective market research affordably and efficiently.

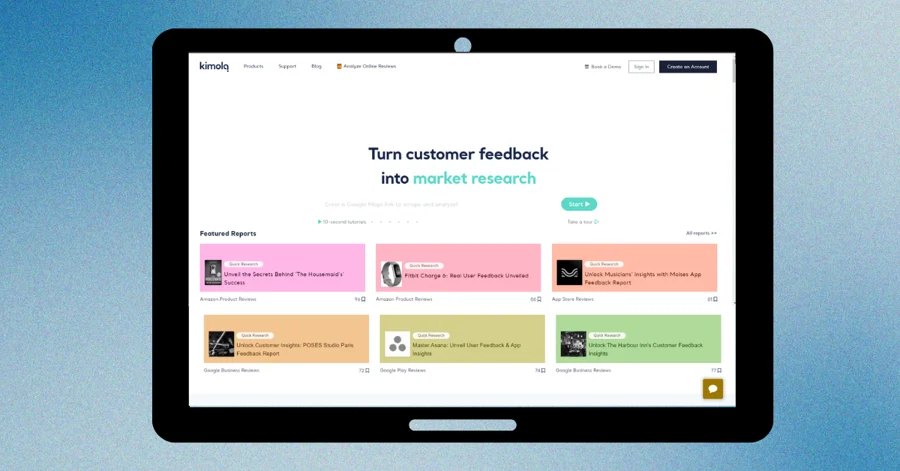

This is where Kimola steps in. We leverage AI to transform customer feedback from platforms like Amazon and Google Business into insightful market research. Our streamlined approach saves you time and money⏱️💰, making market research accessible and impactful for businesses of all sizes. As you navigate this guide, you'll discover how to use these insights to fuel your business success. Let’s embark on this journey to unlocking the potential of market research for your small business!

Chapter 1: Understanding the Basics

Market research might sound like a buzzword, but it's truly the backbone of any savvy business strategy. At its core, market research is the process of gathering and analyzing information about your marketplace. It’s your bridge to understanding customers' needs, assessing competitors' strengths and weaknesses, and identifying overarching market trends 📊. It’s about making informed decisions that significantly boost your business's chance of success and avoid the trap of entering a market with insufficient demand—one of the top reasons for small business failure.

Statistical data highlights a stark reality: over half of new businesses fail within their first five years , with a significant percentage of these failures due to a lack of product-market fit. This underscores the importance of market research as a strategic endeavor, ensuring businesses set off on the right foot by confirming there's a viable demand for what they offer.

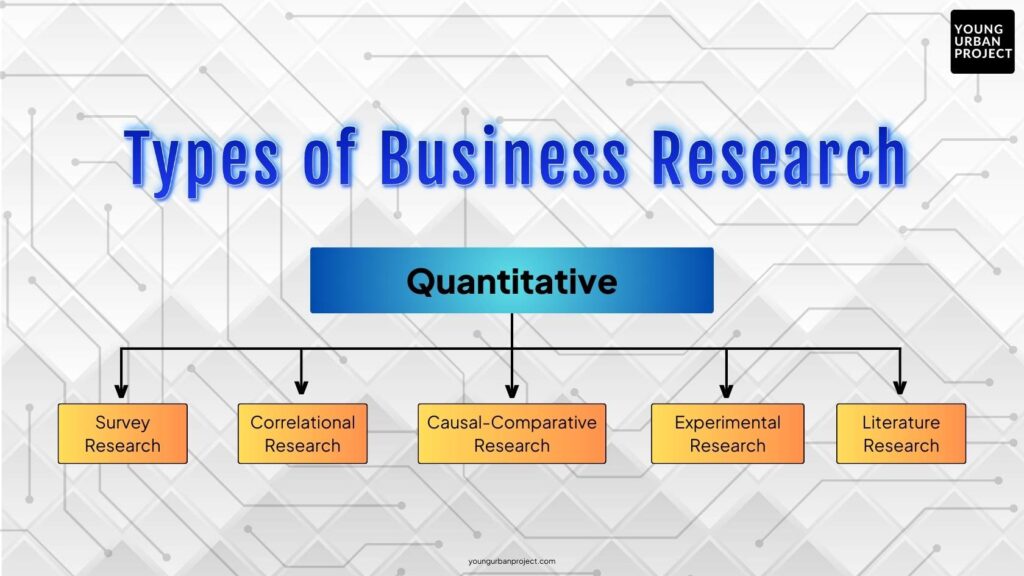

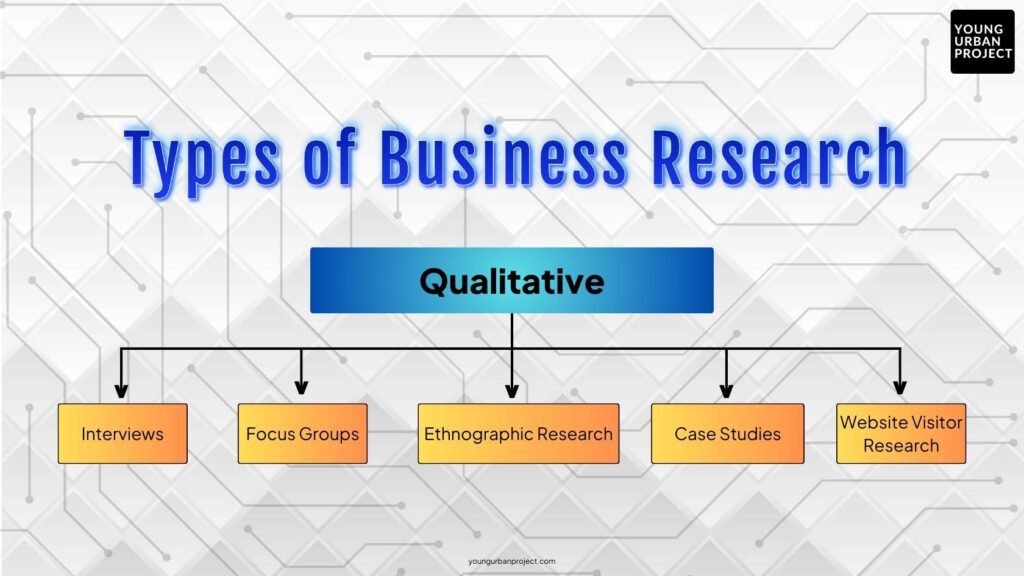

Market research is typically categorized into two key types: primary and secondary research. Primary research involves gathering new data firsthand. It’s all about direct interaction with your target market to understand their behaviors, preferences, or opinions. Common methods include surveys, interviews, focus groups, and observations. On the other hand, secondary research taps into existing data collected by others, such as reports, industry statistics, or customer reviews on platforms like Yelp or Google. It provides a cost-effective way to get a sense of the market landscape without starting from scratch. Additionally, research can be broken down into quantitative and qualitative approaches; the former focuses on numbers and statistical analysis, answering “how many” or “how often” questions, while the latter explores the “why” and “how” behind consumer behavior, providing insights into sentiments and motivations.💭

So why should you invest your time and resources into market research? The answer lies in the myriad benefits it offers, particularly for small businesses. Improved decision-making is one major advantage; with clearer insights into market dynamics and consumer preferences, you can make more informed, confident business decisions. Market research also helps you stay ahead of the curve by identifying trends before they become mainstream, allowing you to adapt or innovate proactively. Knowing what your customers value or where their pain points lie enables you to develop offerings that resonate deeply with them.❤️ Furthermore, understanding your competitors’ strengths and weaknesses helps you carve out your unique place in the market and identify opportunities others might miss.

By integrating market research into your business strategy, you gain a deeper understanding of the market, leading to strategies that are not just based on guesswork but on real, actionable data. And remember, small businesses have the unique advantage of being adaptable, so use that flexibility to leverage insights gained from market research to propel your business forward. Let's continue exploring how you can put this knowledge into practice!

Chapter 2: When and How Often Should Market Research Be Conducted for Small Businesses?

Conducting market research is akin to nurturing a garden🌱; it requires regular attention and care to yield optimal results. While some businesses might view market research as a one-off task, truly successful companies recognize it as a continuous process essential for sustaining growth and maintaining a competitive edge. So, when and how often should you carry out market research?🤔

Timing market research around key business moments can significantly enhance its effectiveness. Firstly, before launching a business or new product , research is crucial.🚀 It validates demand, identifies the ideal customer, and understands the competitive landscape, helping shape marketing strategies to align with market needs and avoid costly missteps. Research is also essential before entering a new market . Whether expanding geographically or targeting a new demographic🌍, it’s important to understand the unique market nuances, including cultural differences, purchasing behaviors, and economic conditions.

Periodic research should inform marketing strategies 📈. By staying updated on current customer preferences and competitor actions, you can create campaigns that resonate better with your audience.🎯 Post-launch , continual research is vital to monitor performance, glean insights from customer satisfaction surveys, analyze sales data, and collect feedback to refine offerings. Additionally, significant market changes —such as major economic shifts, emerging technologies, or industry innovations—call for regular research to help businesses stay prepared, adapt strategies, and maintain relevance📉.

As for the frequency, conducting market research quarterly is a solid standard for many businesses. It aligns research efforts with business quarters, allowing timely strategy and goal adjustments by staying updated on customer sentiment and industry trends. A more comprehensive review annually or bi-annually can help reset goals and provide broader industry insights through in-depth strategic planning and competitor analysis. In today’s digital age, real-time monitoring of market dynamics, through tools like social media sentiment analysis or Google Trends analytics, enables decision-making based on the latest insights between formal research projects.

Regular market research is essential for several reasons. It fosters customer-centric decision-making by enhancing satisfaction and loyalty through a deep understanding of customer preferences and behaviors.🤝 It provides a competitive edge by keeping an eye on competitors, allowing differentiation and the capture of new opportunities.🏆 By consistently updating your market landscape understanding, potential risks—from shifts in consumer preferences to economic changes—are identified early, enabling timely intervention.⚠️ Moreover, continuous research drives innovation by uncovering unmet needs and trends, guiding product development and growth strategies.

Chapter 3: Traditional vs. Modern Market Research Methods

Understanding the array of market research methods available is pivotal for any business, especially small ones aiming to stay competitive. Let's explore both the tried-and-true conventional methods and the groundbreaking technological approaches that are reshaping how research is conducted today.

Conventional Research Methods have long served as the backbone of market research. Surveys, focus groups, and interviews are the stalwarts of this traditional method. Surveys, whether online or on paper, enable businesses to efficiently gather quantifiable data from a broad audience, making it easier to identify customer opinions and trends on a large scale.📝 Focus groups, by contrast, involve a small, diverse group of participants discussing a product or service in a moderated setting. They offer rich qualitative insights that delve into consumer motivations and reactions. Interviews provide even more personalized insights, allowing for deep dives into individual perspectives and experiences.

Despite their strengths, these methods do have downsides. Surveys can sometimes lack the depth of emotion or motivation needed for a fuller understanding of the customer psyche. Focus groups and interviews, while rich in detail, can be time-consuming and costly—often requiring skilled moderation and in-depth analysis. For small businesses with limited budgets and resources, these can be challenging to execute on a large scale. However, when managed properly, they still deliver valuable direct feedback and insights from target audiences that can be critical for strategic decision-making.🎯

Leveraging Technology for Research has introduced a transformative horizon for market research. The advent of AI and big data has brought about more efficient, powerful ways to gather and interpret market data, providing significant advantages to agile small businesses.💻 AI excels at processing large volumes of data with speed and precision, identifying patterns and trends that might be overlooked in human analyses. This allows businesses to react quickly to changing market conditions and consumer behaviors📈. Big data enables businesses to compile vast datasets from numerous digital sources—such as social media, online reviews, and transactional data—offering a comprehensive view of market dynamics and consumer preferences.

Innovative solutions, like those offered by Kimola, harness this technology to turn customer feedback from platforms like Amazon or Google Business into valuable insights. With AI-driven analysis, Kimola distills complex textual feedback into strategic insights that help businesses understand customer sentiments and trends without the heavy lifting. This accessibility and scalability of modern tools make sophisticated market research accessible to businesses of all sizes.🚀 For small enterprises, this means having access to powerful insights typically reserved for larger entities, at a fraction of the cost and effort.

In summary, both traditional and modern research methods offer valuable perspectives. By combining the detailed, personalized insights of conventional methods with the breadth and depth offered by modern technology, small businesses can create a comprehensive market research strategy. This integrated approach facilitates a robust understanding of market conditions, enhances the ability to navigate challenges, and spot opportunities for growth. With this strategic base, we can now explore how to apply these findings effectively in your business planning and execution.

Chapter 4: Step-by-Step Guide to Conducting Market Research for Small Businesses

Embarking on a market research journey can be transformative for any small business owner. By peeling back layers of market behavior, you uncover insights that drive your business forward. Here's a detailed guide to making this journey effective and insightful.

Step 1: Identify Your Objectives

The foundation of any successful market research effort lies in clearly defining what you want to achieve. This crucial first step sets the tone for the entire research process, ensuring that your efforts are targeted, organized, and effective. Without well-defined objectives, your research can quickly become unfocused, wasting both time and resources.⏳ Here's how you can refine your objectives to make your market research as effective as possible.

Begin by asking yourself some fundamental questions: What do you need to learn? Why is this information crucial for your business right now? Your objectives could vary widely depending on your current business needs. Perhaps you're looking to understand your customers' satisfaction levels to identify areas for improvement. Knowing how satisfied your customers are can reveal insights into what's working well and what might need enhancement in your products or services.

Alternatively, your focus might be on exploring new market opportunities. This could involve researching potential new customer segments, identifying geographical areas for expansion, or even understanding emerging trends that align with your business capabilities.🌍 Such objectives are critical if you're considering growth or diversification, as they help pinpoint where your efforts may yield the highest returns.

Another common objective is evaluating the potential success of a new product line. Before investing considerable resources into development and marketing, you'd want to gauge if there’s a real demand for your innovative offering. This involves understanding not just the size of the potential market, but also the competitive landscape, pricing strategies, and unique value propositions that will appeal to customers.

To ensure your objectives are robust and actionable, align them with the SMART criteria:

- Specific: Clearly define what you want to achieve. Ambiguity is the enemy of progress, so detail your goals as precisely as possible. For example, instead of saying you want to understand user preferences, specify whether you’re focusing on product features, customer service, or pricing🎯.

- Measurable: Establish criteria for measuring success. This could be quantifiable data such as achieving a certain customer satisfaction score or reaching a specific number of new market leads.

- Achievable: Ensure your goals are attainable. While ambition is good, setting unrealistic targets can lead to frustration and wasted effort. Consider your current resources and timeframe when setting objectives.

- Relevant: The objectives should align with your broader business strategies and priorities. If your primary focus is on customer retention, ensure your research objectives directly contribute to understanding and improving this aspect of your business.

- Time-bound: Set a timeline for when you expect to achieve these outcomes. Deadlines create a sense of urgency and can help keep the research project on ⏱️.

By framing your objectives within the SMART framework, you establish a clear roadmap that not only guides your research activities but also provides a structured way to evaluate their effectiveness. This clarity not only defines the scope of your research but also sets benchmarks for measuring outcomes, ensuring that you can assess the success of your efforts and make informed decisions based on the insights gained.📈 With clearly identified and structured objectives, your market research is positioned to yield meaningful and actionable results that can propel your business forward.

Step 2: Choosing the Right Method

With objectives in hand, assess the various research methods available. You have traditional methods like surveys and interviews, which provide direct engagement and personalized feedback, making them useful for collecting qualitative data. Surveys are excellent for capturing broad, quantitative trends quickly, while interviews offer deeper insights into individual experiences and opinions.

On the other hand, modern research methodologies leverage technology, such as AI and big data analytics, to handle large datasets efficiently. These tools can uncover patterns and insights that manual methods might miss, adapting to the overarching trends that might not be obvious at first glance.🔍 Your choice between these approaches depends on your business needs: do you require the tactile interaction of traditional methods or the extensive reach and efficiency of modern technology? Selecting the right method ensures that the research aligns with your business model and objectives.

Step 3: Data Collection Techniques

With your chosen method in hand, the next focus is on gathering your data, which varies significantly across different sectors. If you’re employing direct methods like focus groups or interviews, these can provide rich, qualitative insights but may require substantial time and resources. On the other hand, indirect methods such as digital analytics leverage sector-specific data sources to gather insights efficiently.📊

Each sector has its own unique data sources. For instance, a retail business might gather data from point-of-sale systems, customer loyalty programs, or social media interactions. A service-oriented business, like a hotel or restaurant, might rely more heavily on customer reviews from platforms like Tripadvisor or Yelp. In the tech industry, app developers might collect data from user feedback on app stores or forums.📱

Technology-driven solutions, such as Kimola’s platform, can automate the collection of customer feedback from these diverse sources. By tapping into specific industry data, Kimola turns feedback into comprehensive datasets suitable for analysis. This automation not only saves time but dramatically increases the breadth and depth of usable insights. As you gather data, ensure it is accurate and aligns with the goals of your research, taking into account the unique characteristics of your sector to maximize the relevance and applicability of your findings.

Step 4: Analyzing and Interpreting Data

Once your data is collected, the next step is to transform it into valuable insights. For simpler datasets, you might analyze by looking for obvious patterns, trends, or recurring sentiments. However, when dealing with more complex data scenarios, employing AI-powered analytics tools can be invaluable. These tools are designed to handle detailed analyses, identifying subtle trends, predicting future behaviors, and presenting data in a format that is easy to digest. This makes interpreting the data effectively crucial to understanding the underlying story about your market and customers' needs.

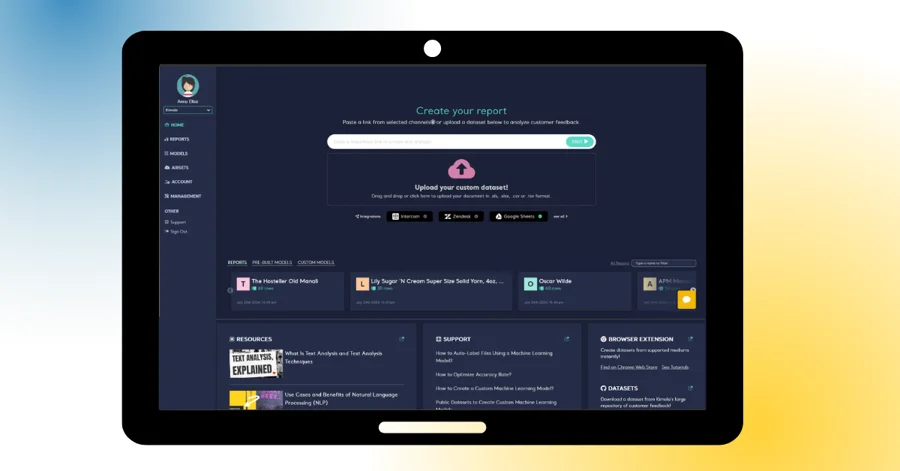

In today's fast-paced market research environment, leveraging technology solutions is essential for gaining a competitive edge, and Kimola stands at the forefront of this transformation. By revolutionizing how customer feedback is turned into actionable market insights, Kimola uses sophisticated AI, machine learning algorithms, and Natural Language Processing (NLP) to process vast amounts of feedback, offering deep insights that fuel business growth. This empowers small businesses to effortlessly tap into the wealth of information available from public review platforms.

Kimola automates the analytics process, eliminating the manual sifting through countless reviews by aggregating and analyzing user feedback in real-time. This efficient method not only saves time and resources but also guarantees access to the most relevant, up-to-date information. The process begins with data scraping from platforms like Amazon, Tripadvisor, Trustpilot, Google Play Store, App Store and Google Business capturing a wide array of customer opinions. Kimola’s robust AI then meticulously analyzes this data, discerning patterns, sentiments, and recurring themes swiftly and accurately, ensuring that no valuable insights are overlooked.

Kimola offers versatile solutions tailored to fit different business needs. Kimola.com is perfect for quick, one-time analyses, providing almost instant insights by entering links from review sites or app stores, with its dynamic classification system organizing the data efficiently without prior training.

For businesses requiring deeper insights, Kimola Cognitive delivers more advanced analytical capabilities, employing multi-label classification to capture nuanced feedback by tagging each review with multiple labels. Its aspect-based sentiment analysis yields detailed insights into specific aspects of products or services, and it also provides the option to analyze your own custom data by simply uploading an Excel file.💾

The user-friendly Kimola platform excels at extracting valuable insights like executive summaries, FAQ lists, and identifying popular features based on customer feedback. These insights are easily integrated into presentations, offering standard performance metrics, pivot tables, and direct comparisons for a comprehensive analysis view. At the end of your analysis, Kimola makes it simple to export findings in multiple formats, such as PPT, Excel, and PDF, facilitating effortless reporting and sharing. By leveraging Kimola.com and Kimola Cognitive, businesses transform raw feedback into strategic tools for decision-making, helping them stay competitive in an ever-evolving landscape.🌟

Step 5: Drawing Conclusions and Taking Action

You've reached the pivotal final step, where all the hard work in gathering and analyzing data transforms into meaningful business impact. This phase involves not only evaluating and interpreting insights but also strategically planning and implementing changes that will drive your business forward.🏆

Start by thoroughly reviewing your insights to understand their implications for your business. Ask key questions like: What do these findings mean for our objectives? How can they be leveraged to inform our decisions, enhance customer experiences, or refine product offerings? This reflection ensures that your insights align with your overall business strategy, directly influencing areas such as customer engagement, market positioning, and competitive advantage.🎯

For instance, if your analysis reveals that customers greatly value a particular product feature, consider increasing investment in its development or highlighting it in your marketing efforts. Alternatively, if a trend shows waning interest in certain products or services, you might choose to reallocate resources to more promising opportunities.

Use these insights to actively enhance your customer experience. If feedback indicates that quick service is appreciated, consider optimizing operational efficiency or investing in technology to improve service delivery. Similarly, if there's growing interest in eco-friendly products, adapting your offerings to meet these demands could increase customer satisfaction and attract a broader audience.

Addressing customer pain points revealed in your data provides golden opportunities for product refinement. Pay attention to areas where customers face challenges or dissatisfaction, and make targeted enhancements. This might involve tweaking a product's design, usability, or functionality to better meet customer needs, thereby improving overall satisfaction and showing your commitment to responding to feedback.

Once actionable strategies are set, develop a plan to implement these changes. Assign responsibilities, set timelines, and establish benchmarks for success to ensure accountability and follow-through. Continuous monitoring is essential to assess whether changes are delivering the desired impact. Collect new data to evaluate outcomes against your initial objectives, and adjust strategies as needed to remain aligned with your goals.

By systematically drawing conclusions and taking decisive action, you transform your market research from a data exercise into a strategic tool for business growth. This approach fosters a culture of continuous improvement, where learning from insights is embedded in your operational strategy, equipping you to navigate the evolving business landscape with agility and insight.

By following this structured approach, market research becomes less of an overwhelming task and more of a strategic advantage. It empowers your small business to thrive with informed, data-backed decisions. With these tools and strategies, you're well-positioned to leverage market insights for success. Keep exploring how this understanding can be strategically applied, continually propelling your business to new heights. This comprehensive process positions you to navigate your market with precision and confidence.🚀

Chapter 5: Market Research in Action

Market research isn't just a theoretical exercise—it's a transformative tool that can be tailored to the unique needs of any business, turning insights into action. Each sector has its own dynamics, meaning different market research steps may be necessary to unlock its full potential. Let’s explore how various types of businesses can effectively deploy market research, drawing from our comprehensive guides crafted for diverse industries.

Imagine you're running a Coffee Shop & Roastery ☕ . By leveraging customer feedback and analyzing popular review platforms, you can uncover what customers love about your blends or what atmosphere keeps them coming back. By understandinging seasonal trends and customer preferences, you can tailor your menu or design weekly specials that engage your audience.

When it comes to Hair & Beauty Salons , market research can reveal trending styles or services that clients are interested in. Salon owners can monitor changes in customer sentiments and adapt services accordingly, ensuring that what you offer remains relevant and desirable💇♀️.

For Fashion Stores , staying ahead means keeping a finger on the pulse of current trends. Market research can provide insights into shifting fashion preferences and help predict upcoming trends. Whether through social media sentiment analysis or feedback from e-commerce platforms, fashion retailers can adjust their stock and marketing strategies to match what consumers are searching for👗.

Fitness Centers can use market research to identify what classes are most popular or what new fitness trends might be worth exploring. Understanding your audience's motivations—whether it’s wellness, community, or specific fitness results—allows you to tweak programs and marketing messages to better align with member goals🏋️♂️.

Running a Hotel requires keen insight into both guest satisfaction and competitor offerings. Market research can highlight areas where your service excels or needs improvement, perhaps by analyzing review data or customer surveys. By constantly refining your service, you can enhance guest experiences and build loyal clientele🏨.

For Hobby Stores , understanding community interests and upcoming trends is key. Are certain hobbies gaining popularity? Are there new products or materials that enthusiasts are talking about? Tapping into online communities and forums through market research can help tailor your inventory and advertising efforts to current demands.

In the realm of Bookstores , trends in reading preferences and popular genres shift.📚 Market research can guide you in selecting what titles to stock and what genres to highlight in displays or online recommendations. Understanding what excites your audience can direct both your purchasing decisions and promotional strategies.

Furniture Stores can utilize market research to grasp consumer desires, whether it’s minimalistic designs, ergonomic features, or sustainable materials.🛋️ By analyzing customer feedback and online shopping behavior, stores can align their offerings with trending consumer preferences and improve customer satisfaction.

For a Car Rental Company , identifying what attributes customers value—such as affordability, luxury options, or eco-friendly vehicles—can improve service offerings.🚗 Market research can also point out frustrations users may experience, directing your focus toward enhancing customer service and convenience.

Travel Agencies thrive on understanding travel trends and consumer preferences.🛫 Whether it’s uncovering top destinations or preferred travel experiences, market research can help tailor packages and promotions that speak to adventurous and budget-conscious travelers alike.

If you’re a Restaurant Owner , feedback can be a goldmine.🍽️ Discover which menu items are crowd-pleasers or what aspects of the dining experience move the needle of satisfaction. This understanding enables the crafting of menus or ambiance adjustments that resonate with guests, fostering loyalty.

For Amazon Sellers , keeping an eye on consumer reviews and competitive analysis is vital.📦 Market research tools can uncover insights into product performance and identify potential areas for differentiation in a crowded marketplace, helping sellers refine their offerings and improve customer satisfaction.

Through these illustrative guides, it becomes clear that market research is not a one-size-fits-all tool. Each industry can derive unique, actionable insights to hone its business strategies, boost customer engagement, and enhance market presence. By applying these tailored insights, any business can thrive, positioning itself not only to meet but also anticipate customer needs. As we continue exploring, let's see how to tackle the challenges that come with market research and strategies to maximize the return on your research investment.

Chapter 6: Overcoming Challenges in Market Research for Small Businesses

Navigating the intricate landscape of market research can present its set of challenges, especially for small businesses juggling numerous tasks. But don’t worry! While hurdles exist, there are effective strategies to overcome them and harness the full potential of market research.💪

Let's start with some common pitfalls you might encounter. Budget constraints often top the list for small businesses. Comprehensive research can seem costly, but it doesn't have to be prohibitive. Start with secondary research using existing data and reports, which can be more budget-friendly💸. Employ free or affordable online survey tools to collect primary data. Modern technologies, like Kimola, offer cost-effective solutions by transforming customer feedback into actionable insights without overwhelming financial demands.

Another challenge is data overload. With so much information available, it’s easy to feel swamped.🌊 Focus on quality over quantity by setting specific research objectives that guide your data collection efforts, ensuring every data piece is purposeful. Use data analytics tools to sift through the noise and highlight insights critical to your business growth.

Analysis paralysis is a real concern when faced with vast data sets. To avoid getting stuck in the weeds, emphasize clarity and prioritize insights aligning with your business goals. Begin with smaller datasets to build confidence, and consider using visual tools to simplify complex data into clear, actionable insights.

Ensuring the reliability and validity of your data is crucial for effective research. When designing surveys, ask straightforward, unbiased questions, and ensure your sample size accurately represents your target market. Cross-validate your findings with multiple data sources, such as comparing survey responses with website analytics, to gain a holistic view. Keeping your research current is vital in our rapidly changing market landscape, so regularly update your data and stay informed on new trends.

Leverage technology wisely to enhance the precision of your research. Tools such as AI and predictive analytics can validate your data and project future trends, helping you anticipate market changes.💡

By addressing these challenges head-on, you refine your market research process, making it more effective and aligned with your business objectives. The goal is to equip your business with insights that fuel growth and innovation, turning potential pitfalls into stepping stones for success. As we continue, let's explore strategies to maximize your return on investment in market research, ensuring it has a powerful impact on your business strategies.

Chapter 7: Maximizing ROI from Market Research for Small Businesses

Investing time and resources into market research is crucial for any business. But to truly benefit, it's essential to focus on maximizing the return on that investment.📈 By effectively integrating your research findings into actionable strategies and measuring their impact, you can drive business growth and enhance customer satisfaction.

The real value of market research lies in how you utilize the insights you gather. Start by aligning your findings with your business goals. For example, if your research reveals unmet customer needs or new market opportunities, use this information to innovate and refine your product offerings or improve customer service strategies.🚀 Incorporate customer feedback to boost satisfaction and loyalty. If the research highlights a demand for faster service or more sustainable products, prioritize those changes. Tailor your marketing strategies to reflect your research insights, ensuring your messaging resonates with your audience’s needs and preferences. This approach not only attracts new customers but also reinforces loyalty among existing ones, fueling growth and satisfaction.

To understand the impact of your research efforts, setting clear Key Performance Indicators (KPIs) is vital. These metrics help measure outcomes like increased sales, improved customer retention rates, and enhanced brand awareness.📊 KPIs serve as benchmarks, providing clarity on the influence of your research on business results. Start by selecting KPIs that align with how you intend to use research data. If you adjusted your product line based on feedback, track the sales performance of those items. For customer service improvements, consider metrics like customer satisfaction scores or net promoter score (NPS). Regularly reviewing these metrics will help you assess progress and identify areas for further improvement.

Benchmarking against industry standards can also offer valuable insights. Comparing your own data with industry averages provides a better understanding of your market positioning and highlights areas that may need attention.🔍 Remember, the ultimate goal of market research is to drive growth and innovation. By continuously integrating findings into your business strategies and rigorously tracking outcomes, you ensure your research investment is working effectively. With these strategies, you are well-equipped to turn insights into tangible business successes, making your business more responsive to market needs and paving the way for sustainable growth and a thriving future. Let's take these insights and keep the momentum going for continued success!

Congratulations on reaching the end of your market research journey!🎉 We've navigated through the essentials of understanding market research, choosing the right methods, digging into the nitty-gritty of data analysis, and learning how to translate insights into action. Along the way, we've looked at practical applications across various industries, tackled challenges head-on, and figured out how to really get the most bang for your buck in terms of ROI.

The road to effective market research isn't always straightforward, but remember, it's a journey worth taking. By using these insights strategically, you're not just gathering data—you're crafting a roadmap for growth and success. Whether you're a cozy coffee shop, a bustling fashion store, or an innovative tech startup, the principles of market research are your allies, helping you understand your customers better, outsmart the competition, and spot opportunities you might have never considered.

As you continue to explore your market, stay curious and open to what the data tells you. Revisit your research regularly to adapt to new trends and changes in consumer behavior. After all, a dynamic business is one that listens and evolves with its audience.

Thank you for joining this journey with us. At Kimola, we're here to support you with tools and insights to make your market research effective and accessible. Remember, your business's success is built one insight at a time, and we’re excited to see where these steps will take you. Here’s to your ongoing success and a future filled with growth, innovation, and satisfied customers!🚀 Keep pushing forward, and never stop exploring. You've got this!💪

We gather global consumer research news and share them with 3,000+ marketing and research professionals worldwide.

Why are Google Business reviews important for your company?

Discover how Google Business reviews can drive your brand's growth and visibility.

Complete Market Research Guide for Game Studios

Unlock gaming success with our guide to market research, from pre-launch to post-launch, using insights to captivate players...

Spooky Update: 3 Features Await in the Shadows

Export all interpretations to Powerpoint and 2 more...

Access all your Kimola products with a single credential.

Join 3,000+ marketing and research professionals from 80+ countries.

Market research is an essential tool for businesses of any size or industry to understand their target audience, identify customer needs and preferences, and gather information about their competitors. In a nutshell, market research helps businesses make data-driven decisions to grow and succeed .

According to the U.S. Bureau of Labor Statistics (BLS), almost 45% of new businesses fail during the first five years, and the reasons are almost always obvious: poor market fit, lack of funds, competition, lousy location, drastic market changes, and others. Most of these challenges can be avoided by understanding customer needs and the market environment, which is what market research does.

Market research may look like an unnecessary step for smaller businesses because it costs money, time, and effort. However, it is an important step that can determine a business’ survival. Although conducting market research can sometimes be expensive and time-consuming, not having proper data can lead to even costlier mistakes and an overall lack of understanding of the market. And market research doesn’t have to be complicated or expensive. In this article, we look at simple steps for conducting market research for small businesses and the important data it can collect.

Steps to Conducting Market Research